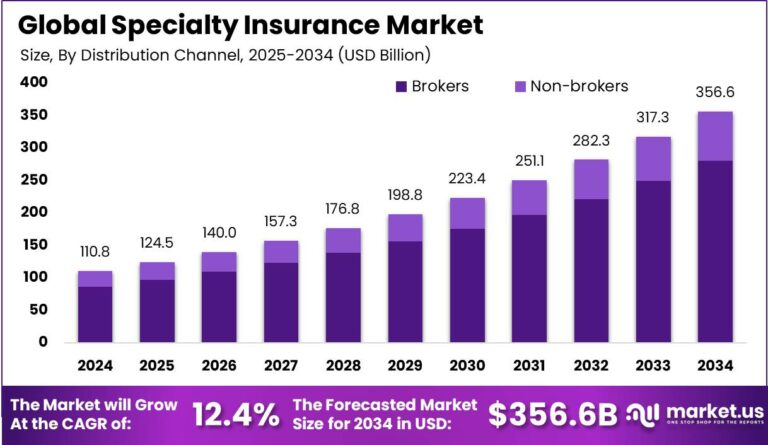

Specialty Insurance Market size is expected to be worth around USD 356.6 Billion

The Global Specialty Insurance Market size is expected to be worth around USD 356.6 Billion By 2034, from USD 110.8 Billion in 2024, growing at a CAGR of 12.40% during the forecast period from 2025 to 2034. In 2024, North America dominated the Specialty Insurance sector with a 35.2% market share and revenues of approximately $39 billion. The U.S. Specialty Insurance Market was valued at $31.2 billion and is projected to grow at a CAGR of 10.2%.

Read more - https://market.us/report/specialty-insurance-market/

Introduction

The specialty insurance market refers to insurance products designed to cover unique, high-risk, or non-standard exposures that traditional insurance policies typically do not address. These products cater to industries, assets, and events that require customized protection. Unlike conventional insurance, specialty coverage is built around niche risks, detailed underwriting, and enhanced risk assessment. The market continues to evolve due to rising awareness of emerging threats, rapid technological advancements, and the specialized needs of global industries.

Market Overview

The specialty insurance market is shaped by increasing demand for tailored risk solutions across sectors such as energy, marine, aviation, cyber, construction, and professional services. Companies and individuals are more aware of vulnerabilities that cannot be addressed through standard insurance, resulting in a shift toward custom-built policies. Market competitiveness is influenced by underwriting expertise, strong broker networks, and the ability to price complex risks accurately.

Key Drivers

-

Emerging risks such as cyber threats, climate-related events, and global supply chain disruptions

-

Industry-specific requirements in marine, aviation, life sciences, and entertainment

-

Rising demand for customization rather than standardized insurance products

-

Technological advancements in analytics and risk modeling

-

Globalization leading to new forms of cross-border liabilities

Market Challenges

-

Complex and resource-intensive underwriting processes

-

Lack of long-term historical data for niche risks

-

High severity of specialty claims

-

Regulatory differences across global markets

-

Capacity constraints for high-risk sectors

Opportunities

-

Expanding demand for cyber insurance

-

Increasing need for environmental and climate-related insurance products

-

Growth of parametric insurance models

-

Rising opportunities in developing markets

-

Enhanced value from insurers that combine technology, consulting, and risk engineering

Key Segments

By Product Type

-

Cyber liability

-

Marine and aviation

-

Directors and officers (D&O) liability

-

Errors and omissions (E&O)

-

Environmental and pollution liability

-

Construction and engineering

-

Event cancellation

-

Kidnap and ransom

-

Energy and power sector insurance

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness