TIKTIKTALK SOCIAL PROFILE vs BUSINESS PAGE: What’s the Difference and Which One Do You Need?

In the age of digital connection, your presence on a social media platform like TIKTIKTALK.COM can define how others interact with you—whether you're a casual user, a public figure, or a business owner. But creating the right type of profile is crucial to ensuring you’re using the platform to its fullest and staying within its guidelines.

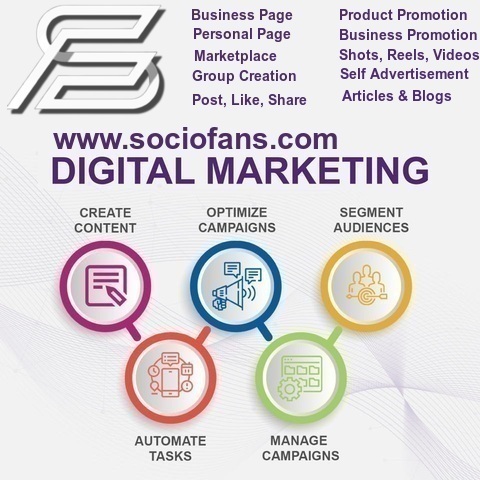

TIKTIKTALK.COM offers two main types of accounts: Social Profiles and Business Pages. While they may look similar on the surface, their functions, features, and intended audiences are very different. Understanding these differences can help you make the right choice and avoid policy violations.

In the age of digital connection, your presence on a social media platform like TIKTIKTALK.COM can define how others interact with you—whether you're a casual user, a public figure, or a business owner. But creating the right type of profile is crucial to ensuring you’re using the platform to its fullest and staying within its guidelines.

TIKTIKTALK.COM offers two main types of accounts: Social Profiles and Business Pages. While they may look similar on the surface, their functions, features, and intended audiences are very different. Understanding these differences can help you make the right choice and avoid policy violations.

TIKTIKTALK SOCIAL PROFILE vs BUSINESS PAGE: What’s the Difference and Which One Do You Need?

In the age of digital connection, your presence on a social media platform like TIKTIKTALK.COM can define how others interact with you—whether you're a casual user, a public figure, or a business owner. But creating the right type of profile is crucial to ensuring you’re using the platform to its fullest and staying within its guidelines.

TIKTIKTALK.COM offers two main types of accounts: Social Profiles and Business Pages. While they may look similar on the surface, their functions, features, and intended audiences are very different. Understanding these differences can help you make the right choice and avoid policy violations.