Instant Payments Market Size, Share | Industry Report [2032]

Instant Payments Market Overview:

The instant payments market has experienced robust growth in recent years, driven by technological advancements and shifting consumer expectations. Instant payments, characterized by the immediate transfer of funds between bank accounts, offer a significant advantage over traditional payment methods, which can take several hours or even days to process. This rapid transaction capability is revolutionizing financial services, providing enhanced convenience and efficiency for both consumers and businesses. The market's expansion is fueled by the increasing adoption of digital payment solutions, the rise of e-commerce, and the growing demand for real-time financial transactions.

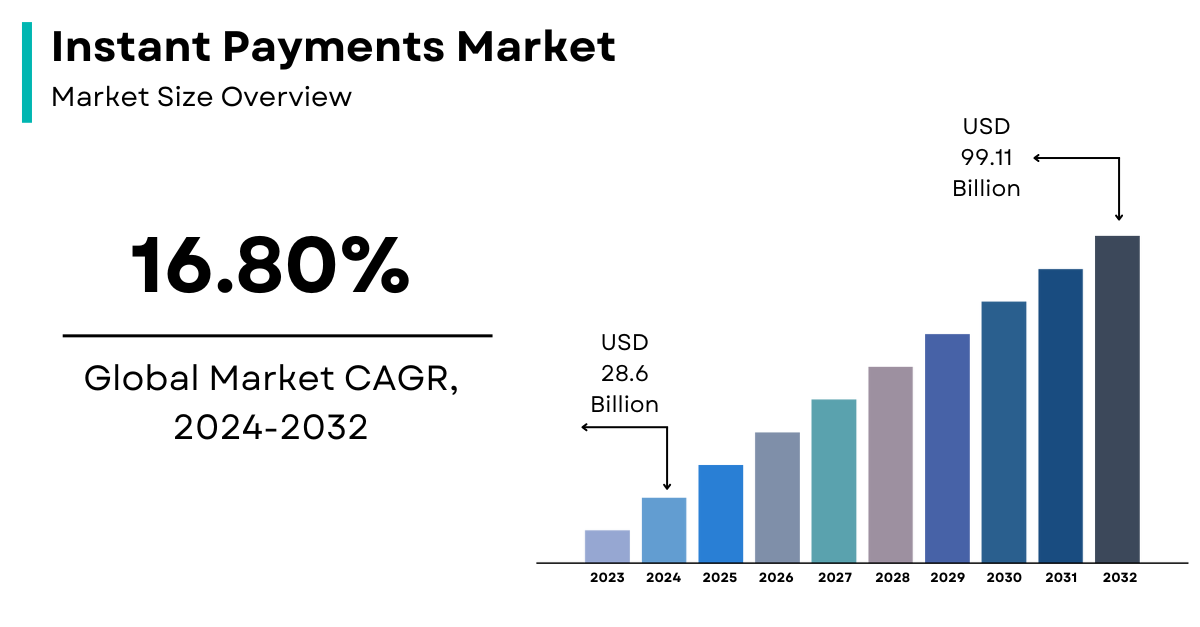

The Instant Payments Market size is projected to grow from USD 28.6 Billion in 2023 to USD 99.11 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 16.80% during the forecast period (2023 - 2032).

Get a sample PDF of the report at –

https://www.marketresearchfuture.com/sample_request/16206

Key Players:

Several key players are shaping the instant payments market, including major financial institutions, technology companies, and payment service providers. Notable players include,

- Visa

- Mastercard Incorporated

- PayPal Holdings

which are leveraging their extensive networks and technological expertise to enhance instant payment capabilities. Additionally, fintech companies like Stripe and Square are making significant strides by offering innovative solutions that facilitate instant payments. Central banks and payment systems operators, such as the Federal Reserve and European Central Bank, are also pivotal in developing and implementing the infrastructure required for seamless instant payment transactions.

Market Trends:

The instant payments market is witnessing several significant trends that are shaping its trajectory. One prominent trend is the integration of artificial intelligence (AI) and machine learning (ML) technologies to enhance transaction security and fraud detection. AI-driven algorithms are increasingly being employed to analyze transaction patterns and detect anomalies in real-time, thereby mitigating risks and ensuring secure payment processing. Another notable trend is the rise of blockchain technology, which offers a decentralized approach to instant payments and enhances transparency and traceability. The proliferation of mobile payment apps and digital wallets is also contributing to the growth of the instant payments market, as consumers increasingly prefer the convenience of managing their finances through their smartphones.

Market Segment Insights:

The instant payments market is segmented based on various criteria, including payment type, end-user, and geography. In terms of payment type, the market is divided into peer-to-peer (P2P) payments, business-to-business (B2B) payments, and business-to-consumer (B2C) payments. P2P payments are gaining traction due to their ease of use and the increasing popularity of digital wallets among consumers. B2B payments are also on the rise as businesses seek faster and more efficient ways to settle transactions with suppliers and partners. B2C payments are driven by the growing e-commerce sector, where instant payments offer a seamless checkout experience for online shoppers.

From an end-user perspective, the market is segmented into retail customers, businesses, and government entities. Retail customers are driving the demand for instant payments through mobile banking apps and digital wallets. Businesses are adopting instant payments to streamline their financial operations and improve cash flow management. Government entities are exploring the use of instant payments for disbursing benefits and subsidies to citizens, enhancing the efficiency of public sector financial transactions.

Regional Insights:

The instant payments market exhibits diverse growth patterns across different regions. North America is a leading market for instant payments, driven by the high adoption of digital payment technologies and the presence of major financial institutions. The United States and Canada are at the forefront of this trend, with widespread use of instant payment systems and ongoing investments in payment infrastructure. Europe is also experiencing significant growth, particularly in countries like the United Kingdom, Germany, and France, where regulatory initiatives and technological advancements are fostering the development of instant payment solutions.

In the Asia-Pacific region, countries such as China, India, and Japan are witnessing rapid adoption of instant payments, fueled by the growing number of smartphone users and the expansion of e-commerce. China's digital payment landscape is particularly advanced, with the widespread use of mobile payment platforms like Alipay and WeChat Pay. Latin America and the Middle East are emerging markets for instant payments, with increasing investments in payment infrastructure and a rising focus on financial inclusion.

Browse a Full Report –

https://www.marketresearchfuture.com/reports/instant-payments-market-16206

Recent Developments:

Recent developments in the instant payments market highlight the ongoing evolution and innovation within the sector. The launch of new instant payment systems and platforms is a key development, with several countries implementing real-time payment schemes to enhance the efficiency of financial transactions. For instance, the European Union's SEPA Instant Credit Transfer (SCT Inst) scheme and the United States' RTP (Real-Time Payments) network are notable examples of initiatives aimed at facilitating instant payments on a large scale.

Additionally, collaborations between financial institutions and fintech companies are driving innovation in the instant payments space. Partnerships between banks and technology providers are enabling the integration of advanced technologies, such as AI and blockchain, into payment systems. The rise of regulatory frameworks and standards for instant payments is also contributing to market growth, as governments and regulatory bodies establish guidelines to ensure the security and interoperability of instant payment solutions.

The instant payments market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and the increasing demand for real-time financial transactions. Key players, market trends, and regional dynamics are shaping the market landscape, while recent developments underscore the ongoing innovation and expansion within the sector. As instant payments become an integral part of the global financial ecosystem, stakeholders must remain agile and adaptable to leverage emerging opportunities and address potential challenges.

Top Trending Reports:

Contact

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness