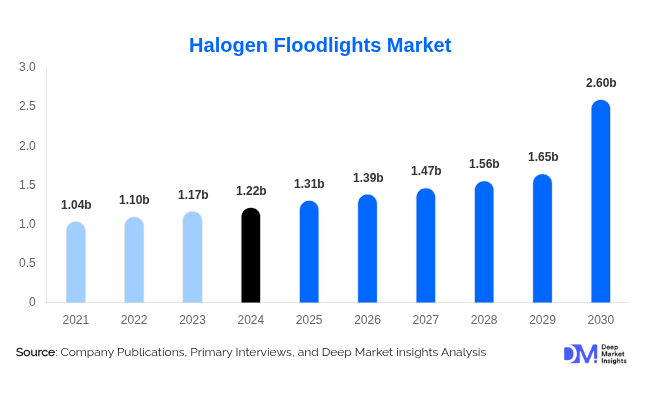

Halogen Floodlights Market to Reach USD 2.6 Billion by 2030, Driven by Construction, Municipal, and Specialized Applications

According to Deep Market Insights, " The global Halogen Floodlights Market was valued at USD 1.22 billion in 2024 and is projected to grow to USD 2.6 billion by 2030, expanding at a compound annual growth rate (CAGR) of 6% during the forecast period (2025–2030)." Despite the rapid shift to energy-efficient LED lighting, halogen floodlights continue to hold a significant share of the market, particularly in cost-sensitive applications, temporary installations, and regions with legacy infrastructure.

Key Market Insights

-

Wattage Demand: The 150W–500W segment dominates the market, offering a balance of affordability, high lumen output, and suitability for commercial and municipal projects.

-

Application Areas: Construction and industrial sites remain top users due to halogen’s durability, affordability, and resistance to voltage fluctuations.

-

End-User Dependence: Government and municipal bodies sustain demand, especially in rural and budget-constrained regions where LED adoption is gradual.

-

Regional Leadership:

-

Asia Pacific leads the global market, driven by infrastructure expansion and cost-sensitive demand in India, Indonesia, and Vietnam.

-

North America shows continued use, supported by legacy infrastructure and phased LED transitions in rural municipalities.

-

Europe is contracting under energy efficiency regulations but maintains niche demand in theaters, film production, and architectural lighting.

-

Halogen floodlights are widely used for outdoor illumination of sports fields, construction zones, concerts, and industrial yards. While LEDs offer greater energy efficiency and lifespan, halogen units remain relevant for budget-focused deployments and legacy system replacements.

Market Trends

-

Energy Efficiency Transition:

Governments and businesses worldwide are prioritizing LED systems. According to the U.S. Energy Information Administration, LEDs can reduce energy costs by up to 75% compared to halogen lighting. This shift is reshaping the long-term market but does not fully displace halogen in cost-sensitive sectors.Example: In March 2025, ACRHT installed solar-powered LED floodlights across 12 km² of NEOM City in Saudi Arabia, replacing older metal halide units to meet zero-carbon goals.

-

Connected Floodlighting Systems:

IoT-enabled floodlights are rising in popularity, allowing users to control and monitor lighting via smartphones, integrate sensors, and track energy use. While this trend favors LED solutions, halogen lights still serve in non-networked, low-cost environments.

Growth Drivers

-

Affordability and High Lumen Output: Halogen units deliver strong illumination at a fraction of the upfront cost of LED systems. Their warm white light and instant full brightness make them suitable for parking lots, warehouses, sports grounds, and outdoor security.

Example: In May 2025, Lighting World Magazine ranked the Philips Halogen PAR38 as a top performer in outdoor security, citing its affordability and broad beam coverage. -

Specialized Applications: Halogen lights remain indispensable in film production, theaters, photography studios, heritage lighting, and specialized agriculture where high color rendering and infrared output are preferred.

Market Restraints

-

High Initial Costs of Alternatives: LED and IoT-enabled floodlighting require higher upfront investments, often two to three times that of halogen systems, making halogen a default choice in budget-constrained regions.

-

Obsolescence Risk: As manufacturers increasingly shift R&D and production to LED and solar-powered solutions, halogen products face reduced availability and regulatory challenges.

Opportunities

-

Smart Cities Integration: While LEDs dominate smart city deployments, halogen floodlights continue to serve as cost-effective interim solutions in urban and rural settings.

Example: In June 2024, Barcelona expanded its Smart Lighting initiative, installing 200 solar-powered LED floodlights integrated with urban surveillance and traffic systems, highlighting the ongoing replacement trend. -

Niche Market Growth: Halogen’s instant brightness, affordability, and superior color rendering make it relevant in film studios, heritage sites, explosion-proof environments, and temporary construction projects.

Regional Highlights

-

North America: Sustained use in municipal infrastructure and public facilities, with aftermarket sales supporting market stability.

-

Europe: Declining overall, but still critical in theaters, film production, and historic building lighting.

-

Asia Pacific: Largest regional market, supported by infrastructure development and rural electrification.

-

Middle East & Africa: Strong adoption for outdoor events, hospitality, and construction sites.

-

Latin America: Widespread use in security, stadiums, and industrial yards, especially in Brazil, Argentina, and Colombia.

Competitive Landscape

Leading companies are investing in durable, application-specific halogen solutions even as they expand LED portfolios:

-

GE Lighting (a Savant Company): Launched the HalogenPro ToughSeries in February 2025, designed for mining and construction with reinforced lenses and metal housing.

-

OSRAM GmbH: Released the VisualStar series in March 2025, targeting studio and broadcast applications with high CRI output.

Other key players include NORDEX, Nordic Lights, STAHL, Rohrlux, RS Pro, Schreder Group GIE, SIRENA, SMP Electronics, STEINEL, Vision X Europe, WISKA Hoppmann GmbH, Wolf Safety Lamp Company, and Yaham Optoelectronics Co., Ltd.

Outlook

The global halogen floodlights market will maintain steady growth through 2030, largely supported by construction, industrial, municipal, and specialized applications. While LED and smart lighting dominate long-term infrastructure projects, halogen floodlights remain critical where affordability, brightness, and legacy compatibility take precedence.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness