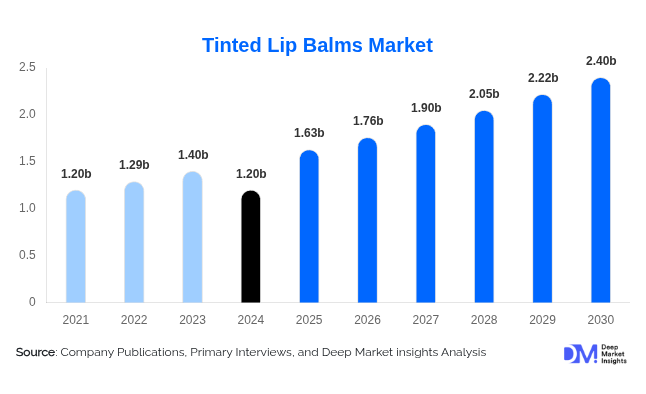

Global Tinted Lip Balms Market to Reach USD 2.4 Billion by 2030 Driven by Hybrid Beauty Trends and SPF Innovation

According to Deep Market Insights, " The global tinted lip balms market, valued at USD 1.2 billion in 2024, is projected to expand from USD 1.63 billion in 2025 to USD 2.4 billion by 2030, registering a compound annual growth rate (CAGR) of 8% during the forecast period."

The market is experiencing robust momentum, underpinned by consumer preference for clean label formulations, vegan ingredients, and sustainable packaging. Tinted lip balms are increasingly sought for their multifunctionality, combining hydration, subtle tint, and sun protection in a single product. Social media engagement, particularly on Instagram and TikTok, has further accelerated adoption, with Gen Z and millennial consumers driving demand for gender-neutral beauty and minimalistic routines.

Key Market Insights

-

SPF-Infused Tinted Lip Balms: Products offering SPF 15–30 are gaining strong traction in regions with high UV exposure.

-

Gender Segmentation: Women remain the largest consumer group, with tinted balms widely used as an alternative to lipstick.

-

Distribution Channel: Online retail dominates, driven by direct-to-consumer (DTC) strategies and influencer marketing.

-

Application Growth: Dry skin-specific tinted balms are witnessing rising demand in colder and low-humidity regions.

-

Regional Dynamics: Asia-Pacific is the fastest-growing market, fuelled by K-beauty and J-beauty trends, while the U.S. market is expanding due to consumer appetite for multifunctional products.

Market Trends

K-Beauty-Inspired Gloss and Hydration

Korean beauty continues to shape global lip care preferences, popularising hydrated, glossy finishes over heavy makeup. In May 2025, Glow Recipe launched its Glass Balm Tinted Lip Treatment, blending fermented plum, raspberry extracts, and hyaluronic acid, generating strong U.S. market buzz.

Integration of Sun Protection

With rising awareness of UV-induced lip damage, SPF formulations are becoming essential. In June 2025, Caliray introduced its Lipguard SPF 31 Lip Gloss Balm, merging sun protection with vibrant colour and moisture. Such innovations underline the growing appeal of hybrid skincare-makeup solutions.

Market Drivers

Multifunctionality in Beauty Products

Consumers increasingly favour efficient products that deliver multiple benefits. Lotus Herbals, for instance, entered the hybrid beauty segment in January 2025 with tinted balms combining hydration, colour, and natural oils.

Social Media and Celebrity Influence

Celebrity endorsements and influencer campaigns significantly boost product visibility. In March 2025, Merit’s Shade Slick Tinted Lip Oil gained traction after being spotlighted by Cameron Diaz and Ayo Edebiri, resulting in 6,000 waitlist sign-ups within weeks.

Market Restraints

Despite strong demand, challenges remain:

-

Short Wear Time: Frequent reapplication limits appeal among consumers seeking long-lasting pigmentation.

-

Heat Sensitivity: Natural emollients may soften or melt in warm climates, raising concerns about portability and consistency.

Opportunities

Emerging Market Expansion

Rising disposable incomes and evolving beauty standards in regions such as India are creating fertile ground for growth. Nykaa’s Wanderlust tinted balm collection, launched during the 2025 wedding season, demonstrated the impact of culturally aligned campaigns.

Personalised Lip Care

Premium consumers are demanding tailored solutions. In May 2024, Augustinus Bader partnered with Sofia Coppola to release a luxury personalised tinted balm line, highlighting the value of exclusivity and customisation.

Regional Highlights

-

North America: Strong demand for multifunctional, sustainable products with high social media influence.

-

Europe: Preference for organic, ethically sourced balms supported by strict regulatory standards.

-

Asia-Pacific: Fastest-growing region, led by K-beauty and J-beauty innovations and a young consumer base.

-

Latin America: Rising adoption of affordable hybrid products from brands like Natura and Maybelline.

-

Middle East & Africa: Growth supported by halal-certified beauty launches and increasing SPF awareness.

Competitive Landscape

The market is characterised by both global leaders and niche innovators.

-

Burt’s Bees remains a top provider with natural, affordable balms highlighted in Sephora’s 2025 listings.

-

Avon continues expanding in emerging markets with its Beyond Glow Lipcure line, targeting hydration and plumping.

-

Other significant players include Maybelline New York, NYX Cosmetics, Rhode Skin, e.l.f. Cosmetics, Estée Lauder, Typology, Summer Fridays, Victoria Beckham Beauty, Nykaa, L'Oréal Paris, Revlon, Byredo, Clinique, Nivea, and The Body Shop.

Recent Developments

-

July 2025 – Rhode Skin launched its Peptide Lip Tint Lemontini shade following its acquisition by e.l.f. Beauty.

-

June 2025 – Byredo introduced a vegan Tinted Lip Care Balm with 92% natural ingredients, offering 24-hour hydration.

-

April 2025 – NYX Cosmetics debuted its Smushy Matte Lip Balm collection in 12 shades enriched with mochi rice powder and ceramides.

Outlook

The tinted lip balms market is on a strong growth trajectory, driven by consumer demand for multifunctional, sustainable, and socially visible products. With innovations in SPF integration, personalised solutions, and hybrid skincare-makeup formats, brands are well-positioned to capture expanding opportunities across both developed and emerging markets.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness