EV Insulation to 2032: Thermal, Electrical, and Acoustic Protection at Scale

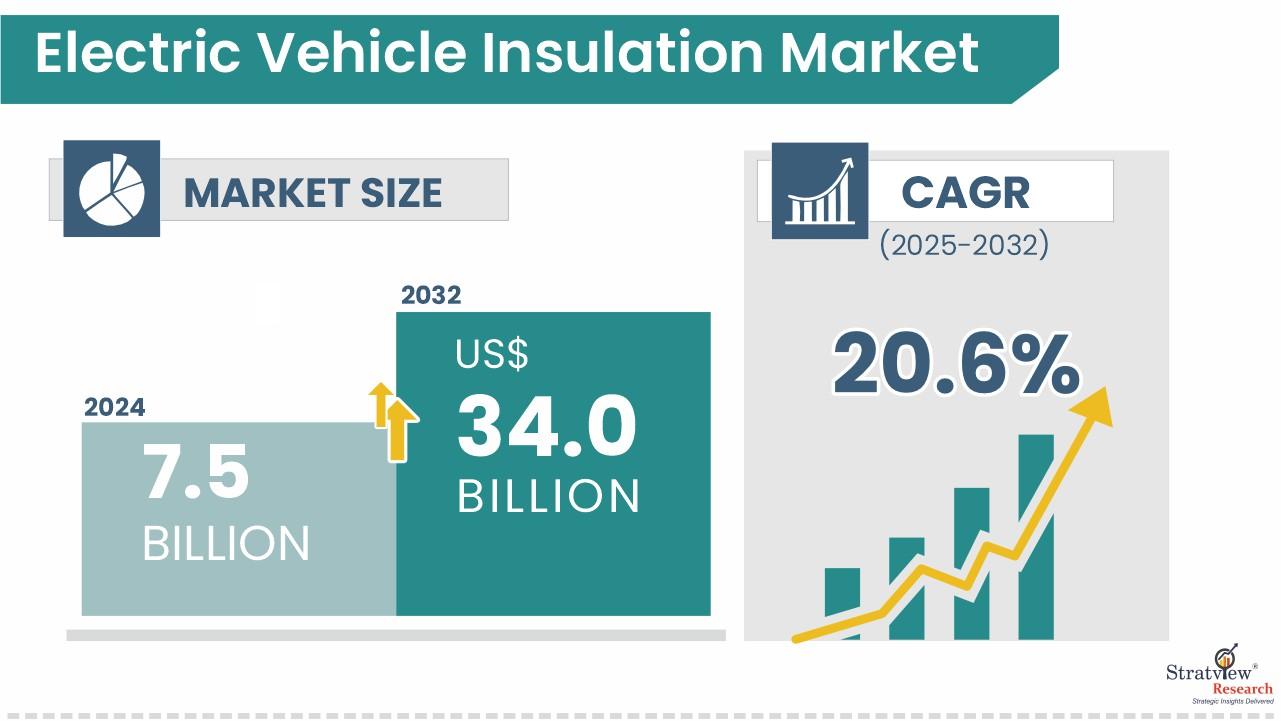

Electric vehicles pack dense electronics—battery packs, inverters, onboard chargers, e-motors, and miles of high-voltage cabling—making insulation a safety-critical layer for heat, noise, and electrical isolation. Stratview Research sizes the electric vehicle insulation market at USD 7.5 billion in 2024, forecasting USD 34.0 billion by 2032 at a 20.6% CAGR (2025–2032). The study covers product, application, propulsion, insulation type, and region.

Download the sample report here:

https://www.stratviewresearch.com/Request-Sample/1091/electric-vehicle-insulation-market.html#form

Drivers

- Rising EV adoption amplified by policy support. Global incentives and zero-emission targets are pulling EV demand forward. As vehicle counts climb, so does the installed base of insulation across the battery pack, power electronics, interior, and wiring domains—multiplying content per vehicle.

- Thermal safety for larger battery packs. High-capacity packs require robust thermal insulation & management to maintain cell temperature windows and limit thermal propagation risk—keeping insulation spend tightly correlated with battery energy growth. Stratview identifies thermal insulation & management as the dominant insulation type through the forecast.

- BEV mix shift. Battery-electric vehicles (BEVs) lead propulsion growth and concentrate the most insulation around packs and power electronics, reinforcing market expansion as BEV share increases.

- NVH and comfort expectations. With the engine’s masking noise gone, acoustic treatments become more important for road/tire/wind noise—another tailwind for interior insulation adoption. (Scope per Stratview application view.)

Trends

- Product mix: foamed plastics on top. Lightweight, impact-resistant foamed plastics (e.g., specialty foams) held the largest share in 2024 and are expected to remain dominant, balancing thermal performance, compliance, and cost. Thermal interface materials (TIMs) and ceramics expand where higher heat flux or dielectric strength is essential (e.g., power electronics).

- Where value concentrates: under-bonnet & battery pack. Insulation around the pack, power electronics, and motor/inverter area remains the largest application—the heart of thermal, electrical, and fire-mitigation needs.

- Regional shape: APAC sets the pace. Asia-Pacific is both the largest and fastest-growing region, reflecting concentrated cell/pack manufacturing, rapid EV adoption, and integrated supply chains across China, Japan, Korea, and India.

- Ecosystem leaders. Stratview lists a broad supplier bench—from materials and components to acoustic specialists—including BASF, 3M, Morgan Advanced Materials, DuPont, Zotefoams, ITW, Saint-Gobain, Von Roll, Autoneum, Alder Pelzer, and Elmelin.

Conclusion

EV insulation is scaling with every new pack and inverter that enters the road fleet. Over 2025–2032, expect thermal insulation & management to remain the anchor, foamed plastics to stay atop the product mix, and APAC to lead demand as BEVs dominate growth. For suppliers, the winning playbook combines certified materials, application-specific laminates and foams, and close co-design with battery and power-electronics engineers—capturing share in a market Stratview pegs at USD 34.0 billion by 2032 (20.6% CAGR).

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness