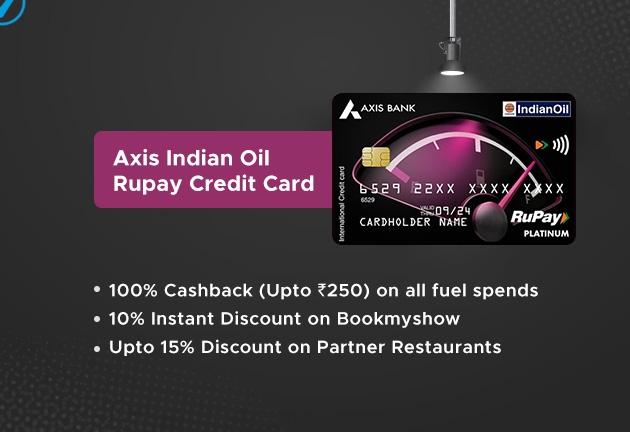

Axis IOCL Rupay Credit Card – Earn accelerated reward points!

Digital

Nuevo

Free

In stock

India

0 Vista previa

Offer Details

About Axis IOCL Rupay Credit Card -

Link your credit card account to your UPI and earn reward points on UPI payments

4% value back on Fuel spends on IOCL outlets (20 RP on every 100 Rs spent)

(Capped at 1000 RP per month, 1 RP = Rs 0.20)

1% value back on online shopping by earning 5 Reward points per 100 Rs spent

Features of the card -

This card gives 100% Cashback (up to Rs. 250) on all IOCL fuel spends made within 30 days of Card Activation.

Earn up to 4% value back on fuel spends made at Indian Oil outlets (Rs. 100 = 20 Reward Points, max. 1000 Reward Points per month)

Earn Reward Points on UPI Payments by linking the card to UPI

Earn 1% value back on online shopping spends

Fees & List of Charges -

Joining Fees: Rs 500 (excluding GST)

Annual fees: Rs 500 (excluding GST)

Annual fees waiver: Rs 50,000 spends in one calendar year

Interest rate: 3.6% per month

Cash Withdrawal charges: 2.5% (Min Rs 500)

Documents Needed -

PAN Card

ID Proof (Aadhaar Card, Voter ID Card, Driving Licence, Passport etc)

Address Proof (Utility Bills, Aadhar card, Driving Licence, Ration Card etc)

Income Proof (Salary Slip, Bank Statement, Form 16 etc)

Eligibility Criteria -

Income - Salaried: starting from Rs 15,000 & Self Employed: starting from Rs 30,000

Age group: 21-65 years

Cibil Score: 730 and above

Available across major cities in India

How to Avail the Offer

User will be redirected to BankKaro

Click Login/Join Now and do OTP verification

Select Axis IOCL Rupay Credit Card and provide the required details

Application will be submitted, and a confirmation SMS will be sent on approval of the application

NOTE: VKYC done over 50km from your Aadhaar/communication address will result in application rejection and loss of profit

About Axis IOCL Rupay Credit Card -

Link your credit card account to your UPI and earn reward points on UPI payments

4% value back on Fuel spends on IOCL outlets (20 RP on every 100 Rs spent)

(Capped at 1000 RP per month, 1 RP = Rs 0.20)

1% value back on online shopping by earning 5 Reward points per 100 Rs spent

Features of the card -

This card gives 100% Cashback (up to Rs. 250) on all IOCL fuel spends made within 30 days of Card Activation.

Earn up to 4% value back on fuel spends made at Indian Oil outlets (Rs. 100 = 20 Reward Points, max. 1000 Reward Points per month)

Earn Reward Points on UPI Payments by linking the card to UPI

Earn 1% value back on online shopping spends

Fees & List of Charges -

Joining Fees: Rs 500 (excluding GST)

Annual fees: Rs 500 (excluding GST)

Annual fees waiver: Rs 50,000 spends in one calendar year

Interest rate: 3.6% per month

Cash Withdrawal charges: 2.5% (Min Rs 500)

Documents Needed -

PAN Card

ID Proof (Aadhaar Card, Voter ID Card, Driving Licence, Passport etc)

Address Proof (Utility Bills, Aadhar card, Driving Licence, Ration Card etc)

Income Proof (Salary Slip, Bank Statement, Form 16 etc)

Eligibility Criteria -

Income - Salaried: starting from Rs 15,000 & Self Employed: starting from Rs 30,000

Age group: 21-65 years

Cibil Score: 730 and above

Available across major cities in India

How to Avail the Offer

User will be redirected to BankKaro

Click Login/Join Now and do OTP verification

Select Axis IOCL Rupay Credit Card and provide the required details

Application will be submitted, and a confirmation SMS will be sent on approval of the application

NOTE: VKYC done over 50km from your Aadhaar/communication address will result in application rejection and loss of profit

Offer Details

About Axis IOCL Rupay Credit Card -

Link your credit card account to your UPI and earn reward points on UPI payments

4% value back on Fuel spends on IOCL outlets (20 RP on every 100 Rs spent)

(Capped at 1000 RP per month, 1 RP = Rs 0.20)

1% value back on online shopping by earning 5 Reward points per 100 Rs spent

Features of the card -

This card gives 100% Cashback (up to Rs. 250) on all IOCL fuel spends made within 30 days of Card Activation.

Earn up to 4% value back on fuel spends made at Indian Oil outlets (Rs. 100 = 20 Reward Points, max. 1000 Reward Points per month)

Earn Reward Points on UPI Payments by linking the card to UPI

Earn 1% value back on online shopping spends

Fees & List of Charges -

Joining Fees: Rs 500 (excluding GST)

Annual fees: Rs 500 (excluding GST)

Annual fees waiver: Rs 50,000 spends in one calendar year

Interest rate: 3.6% per month

Cash Withdrawal charges: 2.5% (Min Rs 500)

Documents Needed -

PAN Card

ID Proof (Aadhaar Card, Voter ID Card, Driving Licence, Passport etc)

Address Proof (Utility Bills, Aadhar card, Driving Licence, Ration Card etc)

Income Proof (Salary Slip, Bank Statement, Form 16 etc)

Eligibility Criteria -

Income - Salaried: starting from Rs 15,000 & Self Employed: starting from Rs 30,000

Age group: 21-65 years

Cibil Score: 730 and above

Available across major cities in India

How to Avail the Offer

User will be redirected to BankKaro

Click Login/Join Now and do OTP verification

Select Axis IOCL Rupay Credit Card and provide the required details

Application will be submitted, and a confirmation SMS will be sent on approval of the application

NOTE: VKYC done over 50km from your Aadhaar/communication address will result in application rejection and loss of profit

Product link:

https://bitli.in/3g0aHFe

https://bitli.in/3g0aHFe

0 Commentarios

0 Acciones

13K Views

0 Vista previa