Battery Leasing Service Market Analysis by Size, Share, Growth, Trends and Forecast (2024–2032) | UnivDatos

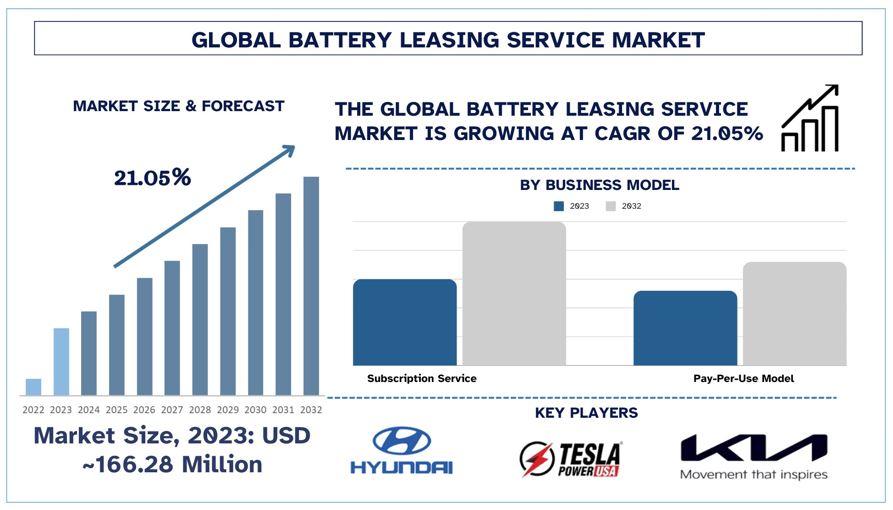

The battery leasing service market is growing quickly because of several factors including new technology innovation, customers’ behavior change, and sustainability consciousness. This market is growing in the different regions of the world with its trends, government regulation policies, and economic and social factors affecting its growth. This paper aims to provide insights into the regional aspect of the battery leasing service market including North America, Europe, and Asia-Pacific. According to the UnivDatos Market Insights, “Battery Leasing service Market” report, the global market was valued at USD 166.28 Million in 2023 and growing at a CAGR of 21.05% during the forecast period from 2024 – 2032.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=65482

North America

Recent Trends: In North America, the battery leasing market has emerged due to the rising EV market and the installment of renewable energy sources. Battery leasing is used by the companies to make it easier for consumers to afford EVs and also it provides more flexibility in the ownership of the batteries. Presently, Tesla and other automotive players are implementing battery leasing strategies, which make it easier for end-users to access EVs without having to own batteries. Also, improvements in battery performance features like faster charging or longer battery life, are improving the battery leasing proposition.

Government Policies: North American policies are playing a crucial role in the battery leasing market. Incentives that the U.S. government has put in place for electric vehicles include tax credits, and rebates therefore encouraging battery leasing in a roundabout way. Likewise in Canada, the iZEV program provides incentives for recharging and purchasing or leasing of EV’s which in turn has given a boost to battery leasing services. Moreover, there is an emphasis on federally-based and state-sponsored programs that are developing the integrated infrastructure for the growth of battery leasing, including electric vehicle charging stations.

Economic and Social Factors: The consumer is forced to take up the leasing option since economic factors like fuel cost variations and expensive battery costs influence their decision. Externally, there has been an increase in consumer consciousness of environmental sustainability and a transition towards environmentally friendly modes of transport which affects the consumer preference for EVs and battery leasing. A higher density of convenient charging networks and advancements in battery technology are also beneficial for battery leasing in the region.

Europe

Recent Trends: Europe is one of the prominent markets to adopt Battery leasing services due to the backing of strong governmental support and its drive to decrease carbon footprints. The European market is already seeing a trend of battery-as-a-service (BaaS), where consumers purchase the use of the battery and not the battery itself. Some car makers like Nio and Renault are at the forefront in this regard with battery leasing strategies Under this model, it is easy to swap batteries on the go. Moreover, Europe is experiencing the rise of second-life battery use, wherein EV batteries that have been depleted are used for energy storage systems.

Asia-Pacific

Recent Trends: There is a growing trend observed in the Asia-Pacific region of battery leasing due to demand for automotive electric vehicles and energy storage requirements. China, India, and Japan are leading this development through different battery leasing schemes. Currently, players such as NIO and BAIC have initiated battery-swapping services in China where cases of EV usage continue to rise primarily in cities. Battery leasing is being considered in India to deal with the costly investment in EVs and align with the government’s vision of electric transportation.

Government Policies: Governments across Asia are applying supportive policies to the development of the battery leasing market. China’s government has offered buying incentives for new EVs, as well as battery-swapping policies. Currently, the Indian government is implementing the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) plan that intends to encourage people to acquire EVs by offering incentives, including battery leasing. Japan is also involved in battery leasing and swapping, which are also aimed at increasing the support of clean energy, especially in the reduction of carbon emissions.

Economic and Social Factors: For instance, low prices of batteries and incentives offered by the government are the economic forces encouraging the use of battery leasing in Asia-Pacific. Environmentally there is an increasing awareness of the environment and the shift from transport fully relying on fossil fuels. The high rate of urbanization especially in the Asian region, coupled with high population density in urban centers increases the demand for efficient and cheap battery leasing solutions. Moreover, the building of local manufacturing capacities and the progress made in the field of battery technology are improving the viability of battery leasing in the region.

Click here to view the Report Description & TOC https://univdatos.com/report/battery-leasing-service-market/

Conclusion:

The battery leasing service market is at the growth stage in general and in different regions, depending on tendencies, governmental regulations, and social and economic impacts. Advanced battery leasing models and supportive policies have originated from North America and Europe, fostered mostly by the sustainability of the environment and better technologies. Thus, the Asia-Pacific region has consistently high growth rates due to the government’s support of subsidies and incentives and the increasing popularity of EVs. While the market is still maturing, regional factors will define the further development of battery leasing; thus, affecting the stance and prospects of key players in the global battery market.

Related Report

Automotive Green Tires Market: Current Analysis and Forecast (2024-2032)

Electric Vehicle Maintenance Market: Current Analysis and Forecast (2024-2032)

Automotive Antifreeze Market: Current Analysis and Forecast (2024-2032)

Automotive Snow Tire Chains Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website - https://univdatos.com/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness