Navigating the Cyber Insurance Landscape in the U.S.: Trends, Challenges, and Government Regulations

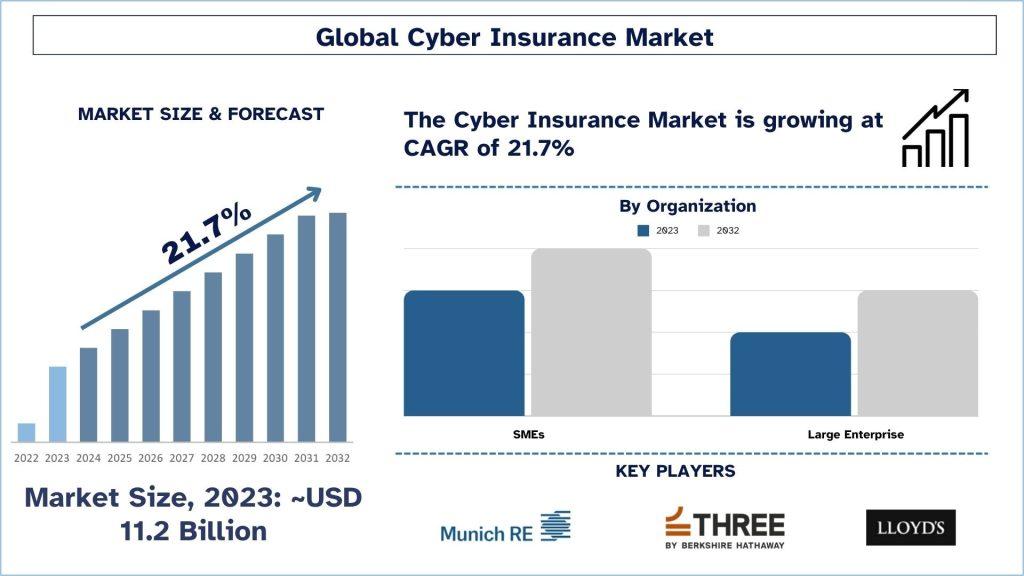

According to UnivDatos Market Insights - The Global Cyber Insurance Market was valued at USD 11.2 billion in 2023 and is expected to grow at a strong CAGR of around 21.7% during the forecast period (2024-2032). With the increased complexity of digital environments, the popularity of cyber insurance in the United States has also grown. From simple data leaks to large-scale ransomware attacks, cyber threats are on the rise, and companies are forced to look for reliable risk mitigation solutions. Cyber insurance offers an option to manage these risks and hence has become a crucial tool in managing risks in United States corporations.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=65258

Trends for the U. S. Cyber Insurance Market

1. Increasing Premiums and Whole Picture Policies

There has been also an increase in insurance premiums as the frequency and severity of cyber incidences continue to rise. Pricing has shifted as insurers look to address rising costs trailing them when payments to those involved in a cyber claim are made. Insights into different insurance sources reveal that in 2022, the average cyber insurance premium went up by nearly 30%.

To satisfy these customers ‘requirements, insurers are providing greater levels of protection. Modern policies can have such risks as data breaches, ransomware payments, disruption of business, and even costs related to compliance with legislation. This evolution is necessary due to the increasing level of sophistication of threats and the demands of individual targets.

2. Risk Assessment and Prevention as a distinct field of study

A second clear emerging trend in the U. S. cyber insurance market converges around the issues of risk evaluation and mitigation. Currently, insurers are insisting that firms pass through a test to be approved for insurance coverage touching on cyber risk. This trend underlines the necessity to have strong protection against probable threats in terms of cybersecurity.

A lot of insurers are developing risk evaluation models and professional services for enterprises to tailor adequate controls. In this way of reasoning, insurers look to prevent risks from rising so that they can increase the efficacy of their available policies.

3. Emergence of Industry-Specific Solutions

The cyber insurance market is gradually evolving as insurers introduce products tailored to individual industries and their specific exposures. For instance, areas like healthcare due to the information it manages concerning patients make it necessary for the coverage to include regulations on compliance needs plus expenses of breaches.

Likewise, the financial sector has its type of risks associated with fraud and theft of data. These challenges have prompted insurers to bring in industry-specific policies and regulatory environments, suitable to the incoming business activities.

Government regulations affecting cyber insurance.

The situation with cyber insurance in the U.S. also depends on the governmental regulation that has been adopted to improve cybersecurity and protect information.

1. Gramm-Leach-Bliley Act (GLBA)

The GLBA requires that financial organizations guard the privacy of pertinent consumer data. Companies need to have sound cybersecurity measures in place and notify their clients of a data breach this made companies investigate the issue of cyber insurance as a way of dealing with possible exposures.

2. The Health Insurance Portability and Accountability Act commonly referred to as HIPAA

HIPAA lays down highly rigid measures for safeguarding patient’s health information. Such rules must be followed by healthcare organizations, and they tend to involve cybersecurity insurance to manage the financial impacts of cybersecurity and the corresponding penalties.

3. California Consumer Privacy Act (CCPA)

The CCPA as an act provides California residents with certain rights for their data and has severe repercussions for violations. This has led to organizations across the U. S reviewing their data protection plan hence increasing the uptake of cyber insurance due to potential legal and compliance risks.

4. Federal Cybersecurity Framework

Due to the rising threat, the U.S. government has put in place some measures which include the NIST Cybersecurity Framework. This framework has norms for containing and mitigating cybersecurity risks in organizations which in turn puts pressure on insurance firms to adopt policies that are by best practices.

The Indications of Concern for the Stakeholders in the Cyber Insurance Industry

1. Lack of Standardization

Another factor that may hinder the growth of the global cyber insurance market is the absence of a unified framework of policy provisions and possible coverages. Insurers continue to come up with various policies that allow businesses to struggle in comparing their policies as well as what is covered under various policies. Such uncertainty creates inconsistency in the scope of coverage and confusion when handling claims.

2. Evolving Threat Landscape

The constantly changing environment from which cyber threats appear is a problem amongst insurers as it hinders their capability to measure and evaluate risks as well as setting best coverage limits. With such threats evolving, it becomes even more challenging for insurers to meet their customers’ needs since they always need to change their policies to correspond to the new threats that they must deal with, and this usually means added cost to insurers.

3. Underreporting of Incidents

Many organizations may underreport cyber incidents due to concerns about reputational damage or regulatory scrutiny. This underreporting can lead to a lack of exact data for insurers, making it challenging to assess overall risk in the market and develop proper coverage options.

Click here to view the Report Description & TOC https://univdatos.com/report/cyber-insurance-market/

Conclusion

The cyber insurance market in the United States has a promising future as businesses begin to appreciate the need to protect themselves from cyber risks. As the market becomes more competitive due to the increase in the premiums of the policies and rate of risk assessment and management, innovative solutions are being developed that are tailored for industries across the board. Moreover, the legal factor includes rules and regulations put in place by the government to regulate security measures and safeguard the policies of organizations.

Hence, organizations should embrace the important practices of updating their knowledge of the latest trends and developments in the availed cyber insurance market. Initiative-taking risk management strategies and adequate coverage are the keys to overcoming difficulties attributed to cyber incidents and preserving corporate assets.

Related Report

Machine Vision Market: Current Analysis and Forecast (2024-2032)

Packaging Automation Market: Current Analysis and Forecast (2024-2032)

Causal AI Market: Current Analysis and Forecast (2024-2032)

Industrial Communication Market: Current Analysis and Forecast (2024-2032)

Sports Analytics Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos Market Insights

Email - contact@univdatos.com

Contact Number - +1 9782263411

Website - https://univdatos.com/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness