Dairy Alternatives Market Demand, Size, Share, Industry Growth Report 2024

Dairy Alternatives Market Size 2024 To 2032

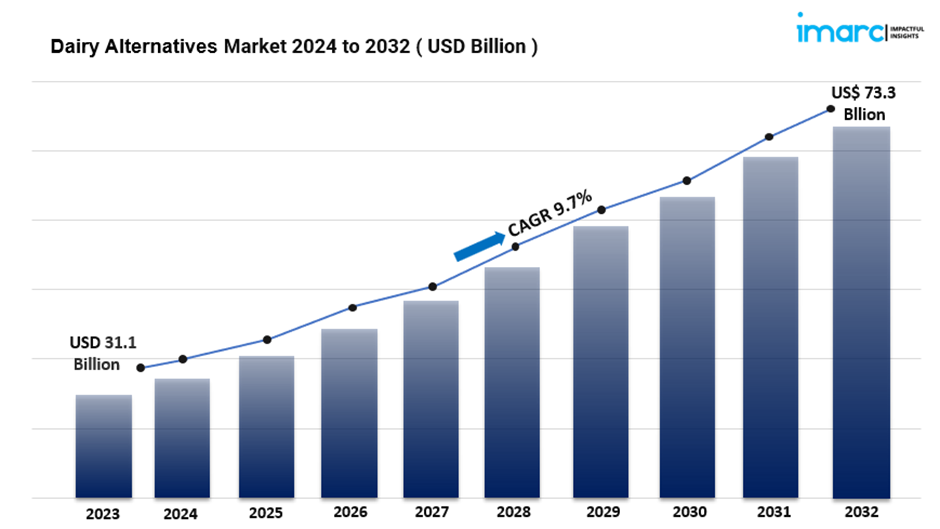

· The global dairy alternatives market size reached USD 31.1 Billion in 2023.

· The dairy alternatives market size is expected to reach USD 73.3 Billion by 2032, exhibiting a growth rate (CAGR) of 9.7% during 2024-2032.

· Asia Pacific leads the market, accounting for the largest dairy alternatives market share due to the large population and increasing lactose intolerance.

· Soy accounts for the majority of the market share in the source segment owing to its long-standing popularity and high protein content.

· Plain holds the largest share in the dairy alternatives industry due to their versatility in cooking and consumption.

· Protein remains a dominant segment in the market because it is crucial for health-conscious consumers.

· Supermarkets and hypermarkets represent the leading distribution channel segment as they offer a broad range of products.

· Milk holds the majority of the market share as it is the most established and widely consumed dairy alternative.

· The rising health consciousness among consumers across the globe is a primary driver of the dairy alternatives market.

· The increasing prevalence of lactose intolerance and emerging vegan and flexitarian diet trends are reshaping the dairy alternatives market

Request to Get the Sample Report:

https://www.imarcgroup.com/dairy-alternatives-market/requestsample

Industry Trends and Drivers:

- Growing Health Consciousness:

The growing awareness of health and wellness is a significant driver of the dairy alternatives market share. Many consumers are shifting towards plant-based diets, not only due to ethical reasons but also for the health benefits they offer. Dairy alternatives, such as almond, soy, and oat milk, are considered healthier because they often contain fewer calories, less fat, and no cholesterol, which can reduce the risk of heart disease and high cholesterol levels.

Furthermore, these alternatives are often fortified with essential nutrients like calcium, vitamin D, and B12, making them a competitive substitute for traditional dairy products in terms of nutritional value.

Consumers concerned about food allergies also benefit from dairy alternatives, as many people are allergic to cow's milk or have lactose intolerance, leading them to seek out plant-based options.

- Rising Prevalence of Lactose Intolerance:

Lactose intolerance is one of the most critical factors boosting the growth of the dairy alternatives market size. A significant portion of the global population is unable to digest lactose due to a deficiency of the lactase enzyme. This condition can cause discomfort and digestive issues, such as bloating, cramps, and diarrhea, upon consuming traditional dairy products. As awareness of lactose intolerance increases, many consumers are shifting towards dairy alternatives that do not cause these adverse effects. Soy, almond, coconut, and rice milk are popular replacements, offering similar uses without triggering symptoms.

Additionally, plant-based yogurts, cheese, and ice creams are gaining popularity among those looking for lactose-free options. The availability of lactose-free alternatives is growing, with supermarkets stocking a wider variety of these products to meet the rising demand.

- Vegan and Flexitarian Diet Trends:

According to the recent market trends, the surge in vegan and flexitarian diets is another powerful force driving the dairy alternatives market. Veganism, once considered a niche dietary preference, has gained substantial mainstream popularity, spurred by concerns over animal welfare, environmental sustainability, and health. A growing number of people are adopting vegan or plant-based lifestyles, which exclude animal products, including dairy. As a result, demand for plant-based dairy alternatives, such as almond, soy, and cashew milk, as well as vegan cheese, yogurt, and ice cream, has skyrocketed.

Moreover, the flexitarian diet, where individuals primarily consume plant-based foods but occasionally eat animal products, is also fueling this market. Flexitarians are not strictly vegan but are choosing dairy alternatives as part of their effort to reduce overall animal product consumption.

Dairy Alternatives Market Report Segmentation:

Breakup By Source:

· Almond

· Soy

· Oats

· Hemp

· Coconut

· Rice

· Others

Soy accounts for the majority of shares due to its long-standing popularity, high protein content, and versatility in various dairy alternative products.

Breakup By Formulation:

Plain

· Sweetened

· Unsweetened

Flavored

· Sweetened

· Unsweetened

Plain formulation dominates the market due to their versatility in both cooking and consumption, appealing to a broad consumer base with neutral flavors.

Breakup By Nutrient:

· Protein

· Starch

· Vitamin

· Others

Protein represents the majority of shares, as it is a crucial nutrient for health-conscious consumers, driving demand for dairy alternatives that provide plant-based protein comparable to traditional dairy products.

Breakup By Distribution Channel:

· Supermarkets and Hypermarkets

· Convenience Stores

· Online Stores

· Others

Supermarkets and hypermarkets hold the majority of shares as they offer a broad range of products, convenient access, and competitive pricing, making them the preferred distribution channel for dairy alternatives.

Breakup By Product Type:

· Cheese

· Creamers

· Yogurt

· Ice Creams

· Milk

· Others

Milk exhibits a clear dominance as it is the most established and widely consumed dairy alternative product, offering a direct substitute for traditional cow's milk.

Breakup By Region:

· North America

· Asia Pacific

· Europe

· Latin America

· Middle East and Africa

Asia Pacific holds the leading position owing to the large population, increasing lactose intolerance, and rising adoption of plant-based diets.

Top Dairy Alternatives Market Leaders:

The dairy alternatives market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

· AK Globaltech Corp.

· Akers Biosciences Inc.

· Alcohol Countermeasure Systems (International) Inc.

· BACtrack Inc.

· Drägerwerk AG & Co. KGaA

· EnviteC-Wismar GmbH

· Intoximeters Inc.

· Lifeloc Technologies

· Mpd Inc.

· Quest Products LLC.

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=1961&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

·

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness