Flat Glass Market Demand, Size, Share, Industry Growth Report 2024

Flat Glass Market Size 2024 To 2032

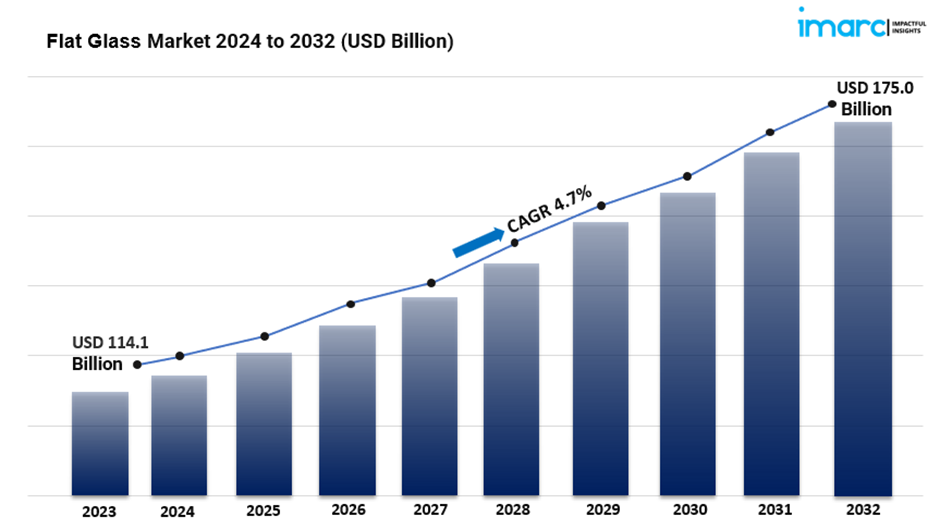

- The global flat glass market size reached USD 114.1Billion in 2023.

- The flat glass market size is expected to reach USD 175.0 Billion by 2032, exhibiting a growth rate (CAGR) of 4.7% during 2024-2032.

- Float glass leads the market, accounting for most of the market share owing to its versatility and widespread applications across various sectors.

- Insulated represents the largest segment due to growing consumer awareness about energy conservation and reduced utility costs.

- On the basis raw material, the market is classified into sand, soda ash, recycled glass, dolomite, limestone, and others.

- Based on the end use, the market is divided into safety and security, solar control, and others.

- Fabricated holds the largest share in the flat glass industry, driven by increasing demand for specialized glass products in diverse applications.

- Construction remains a dominant end-use industry in the market because of continuous investments in infrastructure and residential development projects.

- Asia Pacific leads the market with its rapid economic growth and significant investments in the construction and manufacturing sectors.

- The growth of the flat glass market is significantly driven by technological advancements in glass manufacturing processes, such as the development of smart glass and self-cleaning glass technologies.

- Additionally, the increasing trend toward eco-friendly materials is fueling demand for recycled glass, which offers sustainable alternatives in construction.

Request to Get the Sample Report:

https://www.imarcgroup.com/flat-glass-market/requestsample

Industry Trends and Drivers:

· Rising demand from the construction industry:

The construction sector is one of the largest consumers of flat glass, especially for commercial and residential building projects. Flat glass is used in windows, facades, and interior partitions, providing both functional and aesthetic benefits. The ongoing trend of urbanization and infrastructure development, particularly in emerging economies, has significantly boosted demand for flat glass.

Additionally, modern architectural trends that emphasize natural light and open spaces have increased the use of large glass panes. Technological advancements in glass manufacturing have also enabled the production of high-strength, energy-efficient, and decorative glass products, which are increasingly being used in smart buildings and green construction projects.

· Expanding automotive industry:

Flat glass is a critical component in the automotive sector, being used in the windshields, rear windows, and side windows of vehicles. As the global automotive industry experiences growth, particularly in electric vehicles (EVs), the demand for high-performance flat glass has surged. Modern vehicles require advanced glass solutions that offer better safety, UV protection, and noise reduction. The rising consumer preference for vehicles with large glass sunroofs and panoramic windows further supports this demand. In addition, the trend toward lighter materials to improve vehicle efficiency is driving innovations in lightweight flat glass for automotive applications, such as laminated or tempered glass solutions.

· Increased focus on energy efficiency:

Energy-efficient building materials are becoming a priority in both residential and commercial construction, driven by stricter environmental regulations and the growing awareness of sustainable practices. Flat glass plays a crucial role in achieving energy efficiency by providing insulation and reducing the need for artificial heating and cooling. Innovations in low-emissivity (Low-E) glass, which minimizes the amount of ultraviolet and infrared light passing through without compromising visibility, are gaining traction. These energy-efficient glass solutions help reduce carbon footprints and energy consumption, making them highly desirable in modern architecture.

Flat Glass Market Report Segmentation:

Breakup By Technology:

· Float Glass

· Sheet Glass

· Rolled Glass

Float glass is preferred for its superior optical clarity, smooth surface, and versatility, making it essential for a wide range of applications, including windows and facades.

Breakup By Product Type:

· Basic Float Glass

· Toughened Glass

· Coated Glass

· Laminated Glass

· Insulated

· Extra Clear Glass

· Others

Insulated glass units (IGUs) provide enhanced thermal efficiency and sound insulation, making them ideal for energy-efficient buildings and contributing to their growing market dominance.

Breakup By Raw Material:

· Sand

· Soda Ash

· Recycled Glass

· Dolomite

· Limestone

· Others

On the basis raw material, the market is classified into sand, soda ash, recycled glass, dolomite, limestone, and others.

Breakup By End Use:

· Safety and Security

· Solar Control

· Others

Based on the end use, the market is divided into safety and security, solar control, and others.

Breakup By Type:

· Fabricated

· Non-Fabricated

Fabricated flat glass products, including tempered and laminated glass, are increasingly favored for their strength and safety features, leading to significant market share.

Breakup By End Use Industry:

· Construction

· Automotive

· Solar Energy

· Electronics

· Others

The construction industry drives demand for flat glass due to its essential role in modern architecture, energy-efficient buildings, and aesthetic appeal in residential and commercial projects.

Breakup By Region:

· Asia Pacific

· North America

· Europe

· Latin America

· Middle East and Africa

On a regional basis, the market is segregated into North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

Top Flat Glass Market Leaders:

The flat glass market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies.

Some of the key players in the market are:

· AGC Inc.

· Cardinal Glass Industries Inc.

· Compagnie de Saint-Gobain S.A.

· CSG Holding Co. Ltd.

· Fuyao Glass America Inc. (Fuyao Glass Industry Group Co. Ltd.)

· Guardian Industries LLC (Koch Industries Inc.)

· Nippon Sheet Glass Co. Ltd.

· Taiwan Glass Ind. Corp.

· Turkiye Sise ve Cam Fabrikalari AS

· Vitro S.A.B. de C.V.

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=1496&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness