Algorithmic Trading Market Growth: Key Players & Developments

Algorithmic Trading Market Definition and Overview

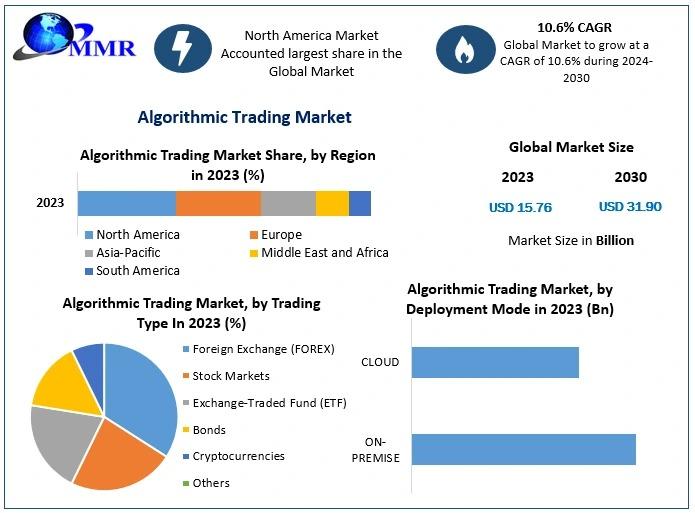

The Algorithmic Trading Industry Growth is experiencing significant growth, with projections indicating an increase from USD 15.76 billion in 2023 to USD 31.90 billion by 2030, representing a robust compound annual growth rate of 10.6% during the forecast period.

Algorithmic trading involves the use of computer programs to execute predefined trading instructions based on variables such as volume, price, and timing. By leveraging complex mathematical models, algorithmic trading enables the automation of trading strategies, allowing for faster and more efficient execution compared to traditional manual trading methods. This approach is widely adopted across various financial markets, including equities, commodities, and foreign exchange.

Market Growth Drivers and Opportunities

Several key factors are propelling the expansion of the algorithmic trading market:

- Technological Advancements: The integration of Artificial Intelligence (AI) and Machine Learning (ML) into trading algorithms enhances predictive analytics and decision-making processes, leading to more accurate and efficient trading strategies.

Get Your Free Sample Explore the Latest Market Insights: https://www.maximizemarketresearch.com/request-sample/29843/

- Increased Adoption by Institutional Investors: Large brokerage firms and institutional investors are increasingly adopting algorithmic trading to reduce trading expenses and improve execution efficiency, thereby driving market growth.

- Demand for Faster and More Efficient Trading: The need for rapid and precise order execution in financial markets is propelling the adoption of algorithmic trading solutions, as they facilitate quicker and more accurate trade executions.

- Regulatory Developments: The implementation of stringent government regulations and the growing requirement for market surveillance are encouraging the adoption of algorithmic trading to ensure compliance and enhance market integrity.

Segmentation Analysis

The algorithmic trading market is segmented based on component, deployment mode, application, and region.

- Component:

- Software: Algorithmic trading software provides the tools and platforms necessary for developing, testing, and executing trading algorithms. These solutions offer functionalities such as backtesting, real-time data analysis, and trade execution.

- Services: This includes consulting, integration, and support services that assist organizations in implementing and optimizing algorithmic trading solutions tailored to their specific needs.

- Deployment Mode:

- On-Premises: Organizations deploy algorithmic trading solutions within their own infrastructure, providing them with direct control over their trading operations and data security.

- Cloud-Based: Cloud deployment offers scalability and remote accessibility, allowing organizations to manage trading operations across multiple locations without significant upfront infrastructure investments.

- Application:

- Equities Trading: Algorithmic trading is extensively used in the equities market to execute large volumes of trades efficiently, minimizing market impact and reducing trading costs.

- Forex Trading: In the foreign exchange market, algorithmic trading enables the execution of complex strategies across multiple currency pairs, enhancing liquidity and market efficiency.

- Commodity Trading: Algorithmic trading facilitates the execution of commodity trades, allowing traders to capitalize on price movements and manage risks effectively.

- Cryptocurrency Trading: The rise of digital currencies has led to the adoption of algorithmic trading in the cryptocurrency market, enabling traders to execute strategies in a highly volatile environment.

Country-Level Analysis

United States:

The U.S. algorithmic trading market is witnessing substantial growth, driven by the high adoption rate of advanced technologies, including AI and ML, in financial services. The presence of major financial institutions and a favorable regulatory environment further contribute to the market's expansion.

Germany:

Germany's algorithmic trading market is expanding due to the country's strong financial sector and emphasis on technological innovation. The integration of algorithmic trading solutions in the German market enhances trading efficiency and competitiveness.

Competitive Analysis

The algorithmic trading market is characterized by the presence of several key players striving to innovate and capture market share. Notable companies include:

- MetaQuotes Software Corp.: Known for its MetaTrader platform, MetaQuotes provides software solutions for developing and executing algorithmic trading strategies in the forex market.

- Trading Technologies International, Inc.: Offers advanced trading software and services, including algorithmic trading solutions for various asset classes.

- AlgoTrader: Provides an algorithmic trading platform that supports multiple asset classes and offers features such as backtesting and real-time trading.

- Kavout: Specializes in AI-driven algorithmic trading solutions, offering predictive analytics and trading strategies for institutional investors.

- QuantConnect: An open-source algorithmic trading platform that allows users to design, test, and execute trading strategies across multiple markets.

For additional reports on related markets, visit our website:

Enterprise Performance Management Market Size Outlook

Conclusion

The global algorithmic trading market is on a dynamic growth trajectory, driven by technological advancements, increased adoption by institutional investors, and the demand for faster and more efficient trading solutions. As financial markets continue to evolve, algorithmic trading is set to play a pivotal role in shaping the future of trading strategies and market dynamics.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness