Life Reinsurance Future Looks Bright with Increased Growth by 2029

Life Reinsurance Market Growth Drivers and Opportunities

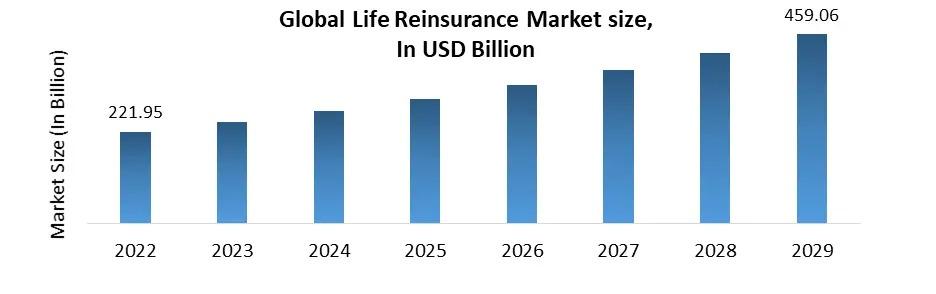

The Life Reinsurance Growth is expected to reach USD 459.06 Billion by 2030, growing at a CAGR of 10.94% during the forecast period. The market's expansion is driven by rising life expectancy, increasing risk awareness, and evolving regulatory frameworks that encourage insurers to mitigate financial risks through reinsurance solutions. The increasing unpredictability of global events, such as economic downturns and pandemics, has heightened the demand for life reinsurance. Insurers are increasingly adopting reinsurance solutions to protect their portfolios from adverse claims scenarios. Additionally, growing life expectancy has led to increased liabilities for insurers, further boosting the demand for life reinsurance to manage long-term risks effectively.

Technological advancements, particularly in predictive analytics and artificial intelligence, are transforming underwriting and risk assessment processes in the reinsurance sector. Companies are leveraging AI-driven models to assess risks more accurately, leading to better pricing strategies and improved profitability. The growing popularity of parametric insurance which allows faster payouts based on predefined triggers is also opening new avenues for reinsurers. Emerging markets present a significant opportunity for growth as insurance penetration remains low, offering potential for expanding life reinsurance coverage in regions like Latin America, Southeast Asia, and Africa.

Segmentation Analysis

The Life Reinsurance Market is segmented based on type, product, and distribution channel.

-

By Type: The market is divided into facultative reinsurance and treaty reinsurance. Treaty reinsurance dominates due to its long-term agreements and cost-effectiveness for insurers. Facultative reinsurance, though used selectively, remains crucial for high-risk cases requiring specific underwriting expertise.

FREE |Get a Copy of Sample Report Now: https://www.maximizemarketresearch.com/request-sample/189286/

-

By Product: The market includes traditional life reinsurance and financial reinsurance. Traditional life reinsurance, covering mortality and morbidity risks, holds the largest share, whereas financial reinsurance is gaining traction for its role in capital management and solvency support.

-

By Distribution Channel: Direct reinsurance and broker-based reinsurance are the two primary channels. Brokers play a crucial role in structuring complex reinsurance deals, while direct reinsurance remains strong among major insurers with in-house expertise.

Country-Level Analysis

-

United States: The U.S. remains the largest market for life reinsurance, with leading global reinsurers operating within a strong regulatory framework. The increasing adoption of solvency regulations and capital adequacy requirements is pushing insurers to expand reinsurance coverage.

-

Germany: As one of Europe’s leading insurance markets, Germany exhibits robust growth in life reinsurance, driven by stringent solvency rules under Solvency II. The market is witnessing digital transformation, with AI-powered underwriting gaining momentum.

-

China: The rapid expansion of the Chinese insurance industry, coupled with regulatory changes encouraging reinsurance adoption, makes China a high-growth market. Government policies promoting long-term insurance products further fuel demand for life reinsurance.

-

United Kingdom: The UK market is influenced by Brexit-driven regulatory shifts, pushing insurers to optimize risk-sharing strategies. London remains a global hub for reinsurance brokerage, facilitating international deals.

-

India: With low life insurance penetration but rising awareness, India presents immense growth potential. Regulatory changes by the Insurance Regulatory and Development Authority of India are encouraging the adoption of reinsurance solutions.

Competitive Landscape and Key Players

The Life Reinsurance Market is highly competitive, with major players focusing on acquisitions, partnerships, and technological innovation. Key players include:

-

Swiss Re – One of the largest life reinsurers, Swiss Re is focusing on digital transformation and AI-driven underwriting.

-

Munich Re – Investing heavily in climate and longevity risk management solutions to strengthen its market position.

-

Hannover Re – Expanding its presence in emerging markets with innovative reinsurance products.

-

SCOR SE – Enhancing risk assessment capabilities with AI-based analytics.

-

Reinsurance Group of America – Strengthening its position in financial reinsurance and longevity risk coverage.

Conclusion

The Life Reinsurance Market is on an upward trajectory, driven by increasing risk complexities, regulatory changes, and technological advancements. As insurers seek innovative ways to manage liabilities and enhance capital efficiency, the demand for advanced reinsurance solutions is expected to rise. With growing adoption in emerging markets and continued digital transformation, the industry is poised for substantial growth, offering lucrative opportunities for both established players and new entrants in the sector.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness