Mexico Consumer Lending Market Share & Demand Forecast 2025-2033

Market Overview 2025-2033

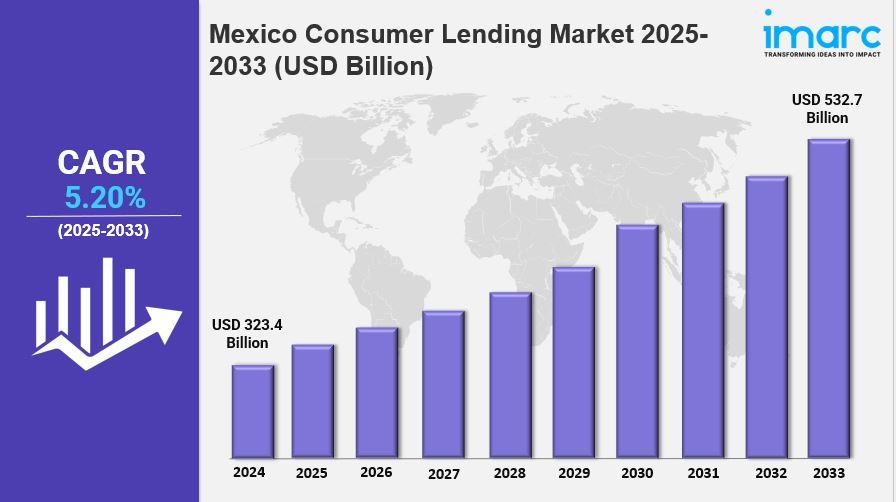

Mexico consumer lending market size reached USD 323.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 532.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The Mexico Consumer Lending Market is witnessing substantial expansion, fueled by a growing middle class, increased access to digital financial services, and a shift towards credit-based consumption.

Prominent trends include the rising popularity of personal loans and fintech solutions, with leading institutions emphasizing customer-centric approaches and enhanced risk assessment technologies.

Key Market Highlights:

✔️ Strong growth driven by a burgeoning middle class and digital financial access.

✔️ Rising demand for personal loans and credit products among consumers.

✔️ Enhanced focus on customer experience and innovative fintech solutions.

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-consumer-lending-market/requestsample

Mexico Consumer Lending Market Trends and Drivers:

The Mexico Consumer Lending Market is undergoing significant transformation, driven by advancements in technology and changing consumer behaviors. As digital platforms gain traction, more individuals are turning to online lending solutions for their financial needs.

This shift is not only enhancing accessibility but also increasing the overall Mexico Consumer Lending Market Size, as more consumers seek loans for personal use, education, and home improvements. The convenience of applying for loans through mobile apps and websites is reshaping how consumers engage with financial services.

In this evolving landscape, the competition among financial institutions is intensifying. Traditional banks are adapting their strategies to retain market share against emerging fintech companies that offer innovative products and streamlined processes.

The Mexico Consumer Lending Market Share is becoming increasingly fragmented, with fintech firms capturing a notable portion of the market. These companies are leveraging technology to provide tailored lending solutions, appealing to younger consumers who prefer digital interactions over traditional banking methods.

Moreover, the regulatory environment is also playing a crucial role in shaping the Mexico Consumer Lending Market Growth. Recent reforms aimed at promoting financial inclusion and protecting consumers are encouraging responsible lending practices.

As regulations evolve, lenders are better equipped to assess creditworthiness, which is essential for sustainable growth. This focus on responsible lending is expected to contribute positively to the overall market dynamics, fostering a more transparent and competitive lending environment.

Looking ahead, the Mexico Consumer Lending Market is poised for robust expansion. With increasing economic stability and rising disposable incomes, more consumers are likely to seek credit options to finance their aspirations.

As the market continues to mature, the interplay between traditional banks and fintech companies will be pivotal in determining future trends. The emphasis on customer-centric solutions and technological innovation will ultimately drive the Mexico Consumer Lending Market Growth, paving the way for a vibrant and diverse lending ecosystem.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22162&flag=C

Mexico Consumer Lending Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Type Insights:

• Personal Loans

• Credit Card

• Auto Lease

• Home/ Mortgage Loans

• Others

Application Insights:

• Individual Use

• Household Use

Regional Insights:

• Northern Mexico

• Central Mexico

• Southern Mexico

• Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion. IMARC's services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness