What’s Driving Adhesive Films—Chemistry Choices, Application Depth, and the Road to 2032

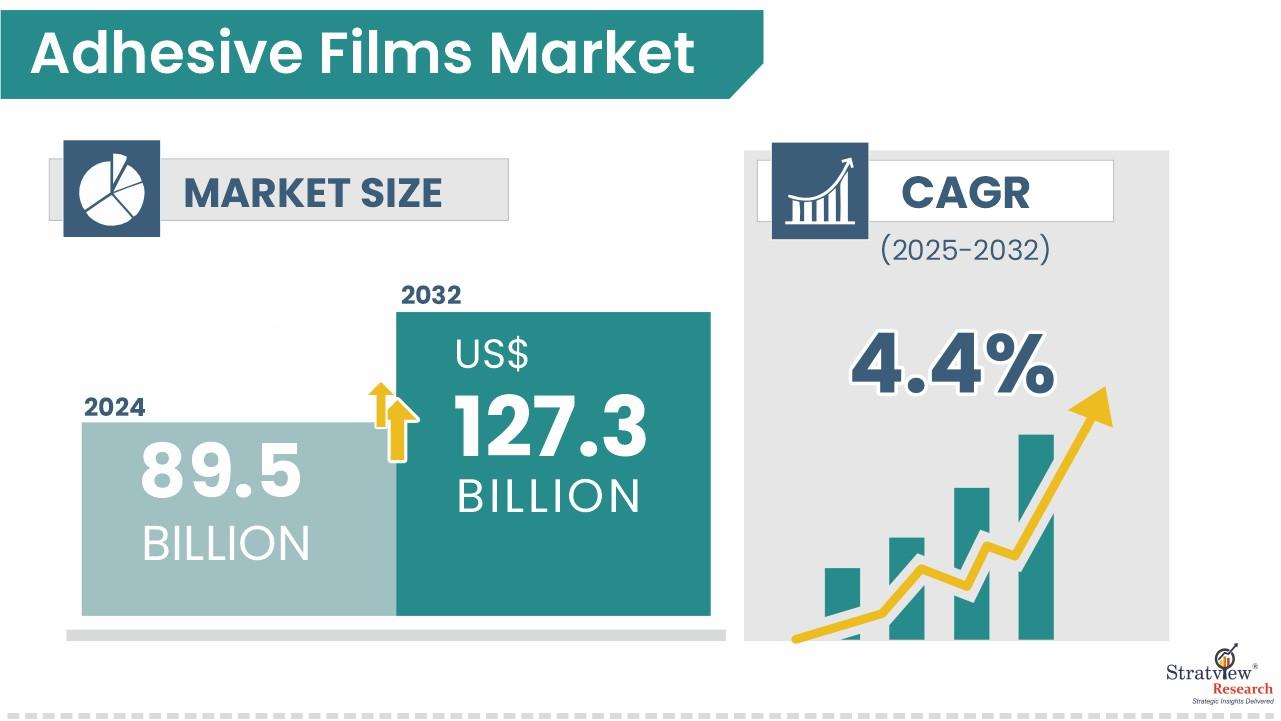

Adhesive films enable fast, clean, and repeatable bonding across industries—replacing mechanical fasteners and liquid adhesives in many workflows. Stratview Research sizes the adhesive films market at USD 89.5 billion in 2024 and forecasts it to reach USD 127.3 billion by 2032 (4.4% CAGR, 2025–2032), reflecting broad-based adoption in packaging, electronics, transportation, and graphics.

Request the sample report here:

https://stratviewresearch.com/Request-Sample/3710/adhesive-films-market.html#form

Drivers

Three structural trends explain the market’s resilience. First, format advantage: films ship as ready-to-apply rolls or die-cuts, cutting cleanup and cure time while boosting line speed. That’s attractive in high-volume packaging/label converting and in electronics assembly where throughput and repeatability matter.

Second, chemistry breadth. Stratview identifies acrylic, rubber, and silicone as the core resin families used in adhesive films. Each chemistry brings a distinct performance envelope—acrylics for optical clarity and aging resistance; rubber for high initial tack and cost-effectiveness on rough substrates; silicones for high-temperature and low-surface-energy bonding—letting converters tune constructions to the job. Acrylics are expected to remain the largest demand generator in the forecast period.

Third, material versatility. PP, PVC, and PE dominate as base film materials, offering a spectrum of modulus, clarity, and cost points; these materials cover everything from commodity pack/label stock to premium outdoor graphics, protective films, and device assembly layers. Product managers can balance film gauge, coat-weight, and adhesive type to hit price-performance targets across end-uses.

Regionally, Asia-Pacific leads and is expected to retain primacy, given the region’s concentration of packaging converters, electronics manufacturing services (EMS), and auto/2-wheeler OEM supply chains. That scale advantage accelerates iteration, drives down total applied cost, and promotes rapid qualification of new constructions.

Challenges

Even as the market expands, stakeholders face four practical headwinds.

- Sustainability & compliance: Customers are pushing toward solvent-reduction, water-borne or 100%-solids systems, recycled content, and mono-material pack designs that simplify end-of-life. Migrating legacy constructions without sacrificing adhesion, printability, or clarity requires reformulation, potential process changes, and close brand-owner collaboration.

- Cost discipline: Resin, monomer, and film substrate volatility (PP/PVC/PE) complicates pricing and inventory planning. Suppliers must hedge feedstocks, rationalize SKUs, and design for coat-weight efficiency to preserve margins.

- Performance on difficult substrates: Low-surface-energy plastics, powder-coated metals, and textured surfaces require tailored chemistries and primers. As EVs and mini-LED/OLED assemblies proliferate, specifications for outgassing, ionic purity, thermal stability, and residue-free removability are tightening.

- Quality and cleanliness: High-value applications (optical, medical) demand near-zero contamination, low haze, and precise slitting/die-cutting. Meeting these requires investments in clean-room converting, web inspection, and process controls that not every supplier can match.

Conclusion

Adhesive films will continue to outgrow many legacy fastening and liquid-bonding approaches because they streamline manufacturing and elevate finished-product performance. The market’s climb to USD 127.3 billion by 2032 will be underpinned by acrylic-led chemistries, PP/PVC/PE material platforms, and the sheer scale of Asia-Pacific converting ecosystems. Suppliers that align their roadmaps to sustainability (solvent-light or solvent-free, recyclable/mono-material designs), strengthen technical support for demanding substrates, and invest in cleanliness and precision converting will be best positioned to capture premium share as requirements tighten across packaging, electronics, graphics, and transportation.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness