In-Flight Entertainment Market — Outlook, Opportunities, and Key Trends

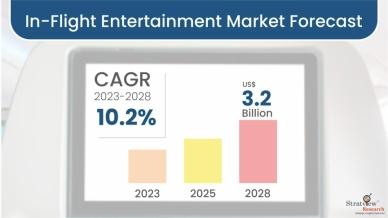

In-Flight Entertainment & Connectivity (IFEC) combines onboard content delivery with connectivity services such as Wi-Fi or satellite communications, enabling streaming, real-time internet access, and more. According to a Stratview Research report, the global In-Flight Entertainment Market is expected to grow at a Compound Annual Growth Rate (CAGR) of ~10.2% during 2023-2028, reaching USD 3.2 billion by 2028.

Download the sample report here:

https://www.stratviewresearch.com/Request-Sample/3063/in-flight-entertainment-market.html#form

Drivers

- Demand for better passenger experience & differentiation: Airlines increasingly see IFEC as a way to differentiate their services, improve customer satisfaction, and generate ancillary revenue (through content, ads, or even connectivity fees).

- Technological advances & reduced costs: Wireless access points, better satellite connectivity (Ku-band, Ka-band), lighter hardware, and better streaming solutions are making IFEC more feasible, both in terms of performance and cost.

- Regulatory & airline pressure for connectivity: Passengers expect Wi-Fi / internet access; connected aircraft also provide benefits for operations (crew safety, monitoring). Airlines thus are being pushed to integrate connectivity more robustly into their systems.

- Fleet expansion and retrofit demand: As airlines expand their fleets and also update existing ones, the demand for line-fit (new aircraft) and retrofit IFEC systems is growing. Regions growing aviation fleets (Asia, Middle East) are especially active.

Trends

- Hardware vs content vs connectivity breakdown: IFEC market segments into hardware (screens, displays, servers), connectivity (internet), and content services. Among these, connectivity is often the fastest-growing segment, as streaming, internet usage, and demand for live content increase.

- Wide-body aircraft leading growth in IFEC connectivity: Long-haul, wide-body aircraft are likely to see faster adoption of high speed connectivity, better displays, more content variety, because of longer flight durations and greater expectation of passenger comfort.

- OEM vs aftermarket split: Original equipment (line-fits on new aircraft) remains large, but aftermarket (retrofits) is growing faster in many regions as airlines seek to upgrade fleets without buying new aircraft.

- Focus on wireless systems, BYOD, and streaming: Wireless IFE, Streaming to passenger devices, internet-enabled content, and reducing reliance on seatback screens are major trends. Airlines want lighter systems, lower power consumption, easier maintenance.

Conclusion

The IFEC market is set for robust growth going into the end of this decade. With projections ranging from USD 7.9 billion by 2028 under IFEC scope (hardware + connectivity + content) and strong growth for pure IFE (~USD 3.2 billion by 2028), the opportunity is significant. Companies in the value chain — hardware manufacturers, service/content providers, connectivity providers — should focus on wireless, lightweight, high speed, and high reliability systems. Regions like Asia-Pacific, where aviation growth is strongest, will be especially important. Also, retrofits of existing aircraft will offer near-term opportunities. Airlines that deliver seamless passenger experience with content, connectivity, and comfort will likely see both customer satisfaction and financial upside.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness