Automotive Market in India: Opportunities for Global Manufacturers and New Entrants 2030

Automotive Market in India to Reach 6.38 Million Units by 2030, Growing at 6.94% CAGR

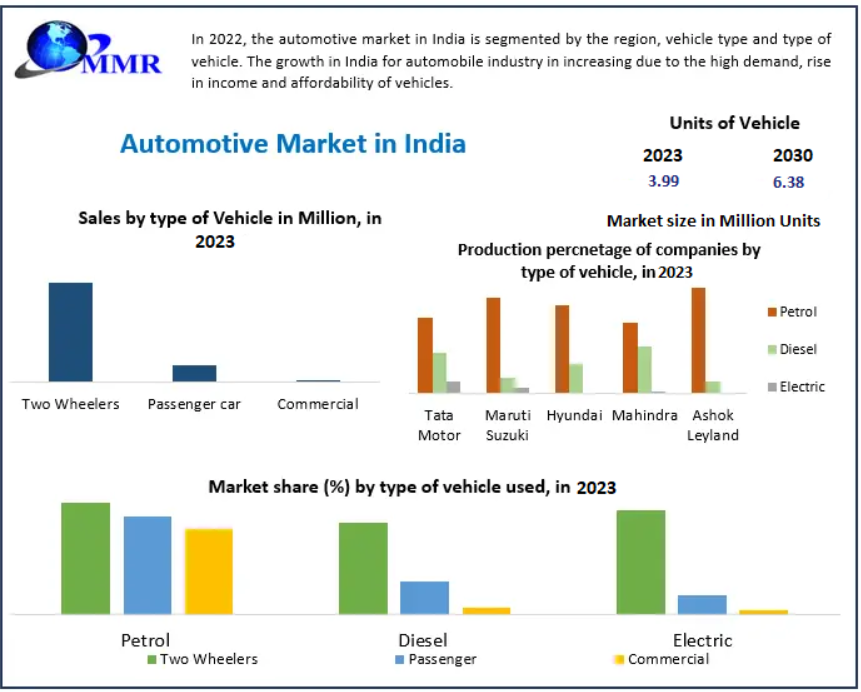

The Automotive Market in India accounted for 3.99 million units in 2023 and is projected to reach 6.38 million units by 2030, expanding at a CAGR of 6.94% during the forecast period. Supported by strong domestic demand, rising exports, government initiatives, and increasing adoption of electric and connected vehicles, India is emerging as one of the world’s largest and most dynamic automotive markets.

Market Overview

The Indian automotive industry encompasses the production, manufacturing, and sale of vehicles across categories such as two-wheelers, passenger cars, commercial vehicles, and three-wheelers. Driven by rapid urbanization, evolving transportation laws, and the need for sustainable energy alternatives, the sector has become one of the key pillars of India’s economy.

Innovations in technology, such as connected vehicles, electric drivetrains, and advanced safety systems, are reshaping the market landscape. The government’s push for Make in India and Atmanirbhar Bharat initiatives, coupled with foreign direct investment in auto-components and assembly lines, is enabling India to strengthen its position as a global automotive hub.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/86126/

Market Dynamics

Growth Drivers

-

Demographic Advantage: Rising disposable incomes, expanding middle-class families, and a growing young population are fueling demand for personal vehicles, particularly two-wheelers and compact cars.

-

Urbanization and Infrastructure Growth: Expanding cities, improved road networks, and booming e-commerce have boosted demand for passenger and commercial vehicles alike.

-

Government Initiatives: Policies like the Automotive Mission Plan (2016–2026), lower taxes on electric vehicles, and incentives for hybrid adoption are driving production and adoption across categories.

-

Exports: Indian automobile exports are expanding significantly, with 1.4 million units shipped between April and June 2021, enhancing the sector’s global relevance.

Restraints

-

High Cost of Technology: The integration of EV systems, autonomous driving, and advanced electronics increases vehicle prices, making them less affordable for price-sensitive customers.

-

Environmental Concerns: Rising pollution levels in cities like Delhi and Mumbai are pushing for stricter emission norms, leading to regulatory uncertainty and cost pressures.

-

Fuel Prices: Escalating fuel prices directly affect the affordability and demand for conventional petrol and diesel vehicles.

-

Infrastructure Gaps: Lack of adequate rural road infrastructure and limited EV charging facilities remain challenges.

Segment Analysis

By Vehicle Type

-

Two-Wheelers dominate the market, driven by affordability, fuel efficiency, and suitability for India’s road conditions. Motorcycles lead this segment, followed by scooters and mopeds. Major manufacturers include Hero MotoCorp, Bajaj Auto, Honda Motors, and TVS Motor Company.

-

Passenger Vehicles are witnessing rising sales due to urbanization and lifestyle changes. Hatchbacks, sedans, SUVs, and MUVs/MPVs are increasingly popular, with SUVs recording faster growth.

-

Commercial Vehicles such as trucks, buses, and LCVs are critical for India’s industrial and logistics sectors, with demand supported by infrastructure projects and economic growth.

-

Three-Wheelers remain essential for urban mobility and goods transport, especially in smaller cities and rural markets.

By Fuel Type

-

Petrol Vehicles dominate due to affordability, performance, and availability.

-

Diesel Vehicles remain important in heavy-duty applications, particularly in buses and trucks.

-

Electric Vehicles (EVs) are gradually gaining momentum, supported by government incentives and rising consumer awareness.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/86126/

Regional Insights

-

North India: The largest automotive market, driven by population density, rising urbanization, and high two-wheeler and SUV demand.

-

West India: Strong in commercial vehicles due to proximity to ports and extensive agricultural land. Luxury and sedan markets are also growing rapidly.

-

South India: A hub for IT, education, and young populations, this region leads in two-wheeler usage and is seeing strong growth in SUVs and hatchbacks. It also has a vibrant second-hand car market.

-

East India: The smallest market due to hilly terrains and lower population density. However, demand for two-wheelers is rising in states like Assam and Nagaland.

Competitive Landscape

The Indian automotive market is highly competitive, with domestic leaders and global players actively expanding their presence.

Key Companies Include:

-

Tata Motors Ltd.

-

Maruti Suzuki India Ltd.

-

Mahindra & Mahindra Ltd.

-

Hero MotoCorp Ltd.

-

Bajaj Auto Ltd.

-

Ashok Leyland Ltd.

-

TVS Motor Company Ltd.

-

Eicher Motors Ltd.

-

Force Motors Ltd.

-

SML ISUZU Ltd.

-

Honda Motor Co., Ltd.

-

Hyundai Motor India

-

Daimler AG

-

Piaggio & C.S.p.a.

-

Toyota Motor Corporation

-

Volkswagen AG

-

AB Volvo

These companies are investing heavily in R&D, EV manufacturing, and new production facilities. For instance, Maruti Suzuki announced an investment of Rs. 18,000 crore for a new plant in Haryana, while Hyundai invested Rs. 2,000 crore in new headquarters in Gurugram. Mahindra & Mahindra committed USD 403 million toward EV development, reinforcing the sector’s focus on sustainability.

Future Outlook

The Automotive Market in India is expected to maintain strong momentum through 2030, driven by:

-

Increased penetration of EVs and connected cars.

-

Expanding exports, especially in two-wheelers and compact cars.

-

Rising investments in R&D and manufacturing facilities.

-

Growing demand in Tier-II and Tier-III cities.

Despite challenges such as rising costs and infrastructure gaps, India’s automotive industry is well-positioned to remain a global hub, both in terms of production and innovation.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness