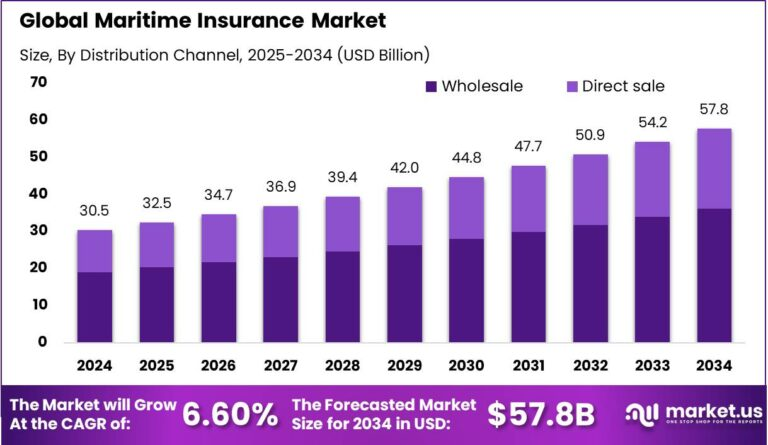

Maritime Insurance Market size is growing at a CAGR of 6.60%

The Global Maritime Insurance Market size is expected to be worth around USD 57.8 Billion By 2034, from USD 30.5 Billion in 2024, growing at a CAGR of 6.60% during the forecast period from 2025 to 2034. The Asia-Pacific region held a dominant position in the global maritime insurance market in 2024, capturing more than 38.2% of the market share, with revenues amounting to USD 11.6 billion.

Read more - https://market.us/report/maritime-insurance-market/

1) What is maritime insurance?

Maritime (or marine) insurance protects parties against financial loss tied to maritime activity: ships and hulls, cargo in transit, offshore installations, port facilities, and liabilities arising from collisions, pollution, crew injury and third-party claims. Core coverages include Hull & Machinery, Cargo, P&I (Protection & Indemnity / liability), Offshore & Energy, War & Strikes, and specialty covers such as Freight, Demurrage & Defence (FD&D).

2) Market outlook (qualitative)

The market is mature and cyclical. Premium volumes and profitability move with global trade levels, shipping rates, vessel values, geopolitics and natural catastrophe frequency. Pricing typically alternates between soft periods (high capacity, competitive pricing) and hard markets (reduced capacity, tight terms, higher rates). Insurers that combine disciplined underwriting with better exposure insight are positioned to produce more consistent returns through cycles.

3) Market segmentation

-

By product: Hull & Machinery, Cargo, P&I / Liability, Offshore/Energy, War & Strikes, Specialist covers.

-

By customer: Shipowners/operators, charterers, cargo owners/shippers, ports & terminals, offshore operators.

-

By distribution: Global brokers and retail brokers, Lloyd’s and syndicates, direct insurers, mutuals/P&I clubs, reinsurers.

4) Top growth drivers

-

Trade value and commodity flows — as value in transit rises, insured exposure grows.

-

Fleet modernization and specialized vessels — higher-value newbuilds and specialized tonnage increase hull exposure.

-

Geopolitical tensions and regional conflicts — raise war-risk and rerouting exposures.

-

Climate change — increased frequency and severity of weather-related losses (storms, flooding) affecting both hulls and cargo.

-

Supply-chain complexity — longer routes, multimodal handoffs and just-in-time logistics increase delay and contingent exposures.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness