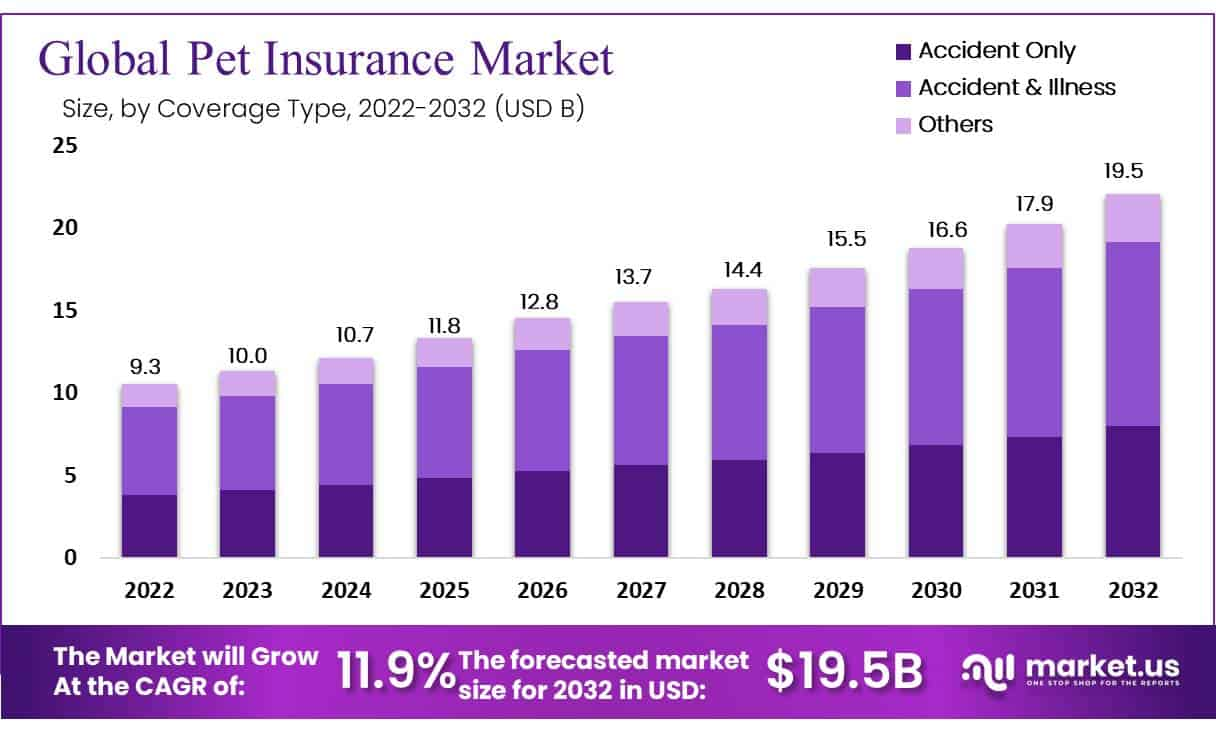

pet insurance market size is expected to be worth around USD 19.15 Bn by 2032

The global pet insurance market size is expected to be worth around USD 19.15 Bn by 2032 from USD 9.3 Bn in 2022, growing at a CAGR of 11.9% during the forecast period from 2022 to 2032.

Read more - https://market.us/report/pet-insurance-market/

Pet insurance covers veterinary costs, wellness, and sometimes liability for companion animals, typically dogs and cats, with expanding coverage into exotic pets. The market has grown as pet ownership, spending on pet healthcare, and awareness of insurance options increase. Insurers offer indemnity, reimbursement, and wellness plans, often with tiered coverage, deductibles, and annual limits. Distribution channels include direct-to-consumer online sales, brokers, veterinarians, and employer benefit partnerships.

-

Coverage types: accident-only, accident & illness, comprehensive (including hereditary conditions), and wellness/preventive add-ons.

-

Typical customers: pet owners (individuals, families) seeking financial protection against unexpected veterinary bills.

-

Distribution: direct digital platforms, insurance aggregators, veterinary partnerships, and employee benefits.

-

Value proposition: financial predictability for pet healthcare, access to higher-quality treatment, and peace of mind.

Market drivers

Key drivers include rising pet adoption rates, humanization of pets (treating pets like family members), higher veterinary costs driven by advanced treatments, and increased awareness of insurance as a risk management tool. Digital onboarding and telemedicine also make purchasing and using pet insurance easier.

-

Rising vet costs and advanced medical options make insurance more attractive.

-

Greater pet ownership and “pet parent” behavior increases willingness to spend.

-

Digital channels and mobile-first apps simplify sign-up and claims.

-

Employer benefits and bundled offerings introduce new customer segments.

Challenges and restraints

Challenges include low penetration in many markets (awareness and perceived value gaps), premium sensitivity, exclusions (pre-existing conditions), and complex claim processes that can deter customers. Fraud, adverse selection, and underwriting risk for certain breeds or conditions complicate profitability.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness