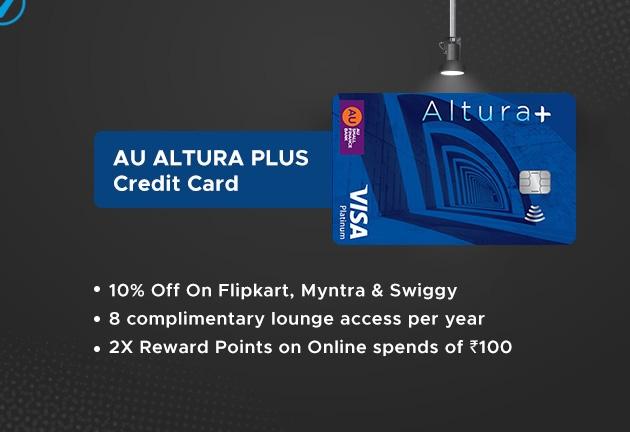

About AU Altura Plus Credit Card -

This card offers numerous benefits like milestone gains, cashback and reward points to experience twice the luxury and double the delights!

Vouchers worth Rs 500 on minimum Rs 10,000 retail spends (within 60 days of card setup)

500 Bonus Reward Points (Worth Rs 125) on retail spends of Rs 20,000 or more in a calendar month. Fuel and cash withdrawal are excluded from reward point spends calculations

More Features of the Card -

1.5% Cashback on all POS retail spends done (Except Fuel) at merchant outlets (Maximum cashback per statement cycle is Rs 100)

2X Reward Points (i.e., 2 Reward Points per Rs 100 retail spends) for all your online transactions

2 complimentary lounge access per calendar quarter, using VISA Card at railway stations in these cities – New Delhi, Kolkata (Sealdah), Jaipur, Ahmedabad and Agra

1% Fuel Surcharge Waiver for fuel transactions done between Rs 400 and Rs 5,000 across all fuel stations in the country

Convert your transactions worth INR 2,000 or more into easy EMI options on selected tenure of your choice

Partner Offers -

5% Instant Discount on shopping at Croma (min. spend Rs 15,000) - Offer valid once per month

15% Off on EasyDiner (min spend Rs 2,500 & max discount Rs 500) - Offer valid once per month

15% Off on Tata CliQ (min spend Rs 500 & max discount Rs 300) - Offer valid once per month

15% Off on Domestic Flight & 10% Off International Flight on Cleartrip - Offer valid once per month

20% Off on Movies Tickets (min spend Rs 500 & max discount Rs 100) - Offer valid once per month

More Amazing E-Comm discount offers from 5% - 25%. Check here :

https://offers.aubank.in/

Fees & List of all charges -

Joining Fees: Rs 499 + applicable taxes (Joining fees will be waived off, if the user spends Rs 20,000 within first 90 days of card issuance)

Annual Fees: Rs 499 + applicable taxes (Annual fees will be waived off, if the user spends Rs 80,000 within first anniversary year)

Eligibility Criteria -

Required Age: 21-60 years

Employment status: Salaried or self-employed

Salaried: Starting from Rs 25,000 Monthly

Self Employed: Starting from Rs 25,000 Monthly

Customers need to have an Existing card (6 months old) with a minimum limit of Rs 30,000

No Delayed Payments in the last 12 months

Required Credit Score: 700+

Documents Needed -

Valid PAN Card

Aadhar Card - should be linked to Mobile (For EKYC)

Address proof

Income Proof (if opted for Income surrogate)

How to Avail the Offer -

User will be redirected to AU Bank's website

Click Login/Join Now and do OTP verification

Select AU Bank Altura Plus Credit Card and provide the required details

Application will be submitted and a confirmation SMS will be sent on approval of the application

About AU Altura Plus Credit Card -

This card offers numerous benefits like milestone gains, cashback and reward points to experience twice the luxury and double the delights!

Vouchers worth Rs 500 on minimum Rs 10,000 retail spends (within 60 days of card setup)

500 Bonus Reward Points (Worth Rs 125) on retail spends of Rs 20,000 or more in a calendar month. Fuel and cash withdrawal are excluded from reward point spends calculations

More Features of the Card -

1.5% Cashback on all POS retail spends done (Except Fuel) at merchant outlets (Maximum cashback per statement cycle is Rs 100)

2X Reward Points (i.e., 2 Reward Points per Rs 100 retail spends) for all your online transactions

2 complimentary lounge access per calendar quarter, using VISA Card at railway stations in these cities – New Delhi, Kolkata (Sealdah), Jaipur, Ahmedabad and Agra

1% Fuel Surcharge Waiver for fuel transactions done between Rs 400 and Rs 5,000 across all fuel stations in the country

Convert your transactions worth INR 2,000 or more into easy EMI options on selected tenure of your choice

Partner Offers -

5% Instant Discount on shopping at Croma (min. spend Rs 15,000) - Offer valid once per month

15% Off on EasyDiner (min spend Rs 2,500 & max discount Rs 500) - Offer valid once per month

15% Off on Tata CliQ (min spend Rs 500 & max discount Rs 300) - Offer valid once per month

15% Off on Domestic Flight & 10% Off International Flight on Cleartrip - Offer valid once per month

20% Off on Movies Tickets (min spend Rs 500 & max discount Rs 100) - Offer valid once per month

More Amazing E-Comm discount offers from 5% - 25%. Check here : https://offers.aubank.in/

Fees & List of all charges -

Joining Fees: Rs 499 + applicable taxes (Joining fees will be waived off, if the user spends Rs 20,000 within first 90 days of card issuance)

Annual Fees: Rs 499 + applicable taxes (Annual fees will be waived off, if the user spends Rs 80,000 within first anniversary year)

Eligibility Criteria -

Required Age: 21-60 years

Employment status: Salaried or self-employed

Salaried: Starting from Rs 25,000 Monthly

Self Employed: Starting from Rs 25,000 Monthly

Customers need to have an Existing card (6 months old) with a minimum limit of Rs 30,000

No Delayed Payments in the last 12 months

Required Credit Score: 700+

Documents Needed -

Valid PAN Card

Aadhar Card - should be linked to Mobile (For EKYC)

Address proof

Income Proof (if opted for Income surrogate)

How to Avail the Offer -

User will be redirected to AU Bank's website

Click Login/Join Now and do OTP verification

Select AU Bank Altura Plus Credit Card and provide the required details

Application will be submitted and a confirmation SMS will be sent on approval of the application